Floor & Decor Holdings (NYSE:FND) sheds 11{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} this week, as yearly returns fall more in line with earnings growth

It hasn’t been the best quarter for Flooring & Decor Holdings, Inc. (NYSE:FND) shareholders, due to the fact the share price tag has fallen 17{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in that time. But that doesn’t transform the simple fact that the returns around the very last five many years have been satisfying. Soon after all, the share rate is up a industry-beating 89{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in that time. Sad to say not all shareholders will have held it for the very long time period, so spare a thought for these caught in the 45{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} decrease more than the previous twelve months.

Though Ground & Decor Holdings has drop US$990m from its market cap this week, let’s acquire a glance at its lengthier term elementary developments and see if they have driven returns.

Verify out our newest analysis for Flooring & Decor Holdings

To estimate Buffett, ‘Ships will sail all around the earth but the Flat Earth Modern society will flourish. There will go on to be extensive discrepancies concerning price and benefit in the marketplace…’ Just one way to study how industry sentiment has changed in excess of time is to look at the interaction involving a company’s share selling price and its earnings for every share (EPS).

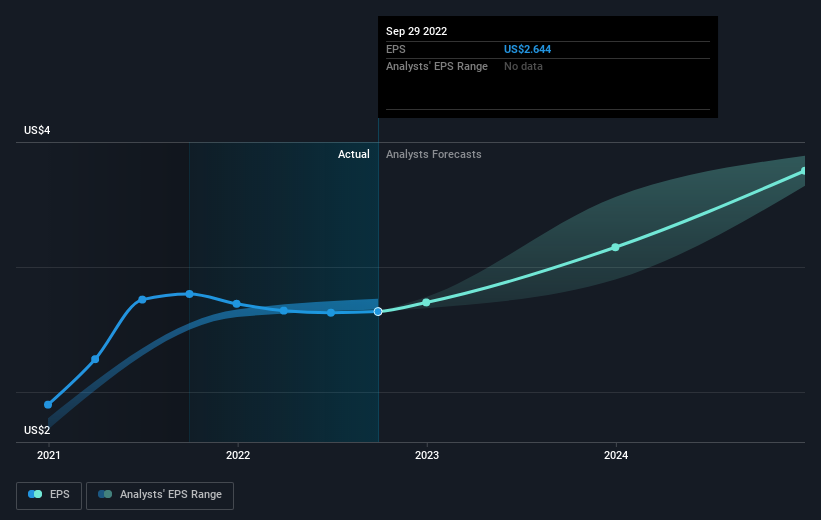

More than 50 {a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} a ten years, Flooring & Decor Holdings managed to develop its earnings for every share at 26{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} a year. The EPS expansion is a lot more outstanding than the annually share rate attain of 14{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} more than the exact same interval. So it would seem the market is not so enthusiastic about the stock these times.

The firm’s earnings per share (in excess of time) is depicted in the picture beneath (simply click to see the specific numbers).

We like that insiders have been purchasing shares in the previous twelve months. Having claimed that, most people today consider earnings and earnings advancement traits to be a far more significant information to the organization. It may be effectively worthwhile using a glimpse at our free report on Flooring & Decor Holdings’ earnings, income and money circulation.

A Distinct Viewpoint

Even though the broader industry lost about 21{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in the twelve months, Flooring & Decor Holdings shareholders did even worse, dropping 45{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}. Possessing claimed that, it can be inevitable that some stocks will be oversold in a slipping industry. The important is to hold your eyes on the essential developments. On the bright side, very long expression shareholders have designed money, with a acquire of 14{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} per yr about fifty percent a 10 years. It could be that the latest offer-off is an opportunity, so it may well be worthy of checking the basic data for indications of a very long term growth development. I come across it very appealing to search at share rate in excess of the extensive term as a proxy for small business effectiveness. But to genuinely acquire perception, we need to have to consider other facts, much too. Take into consideration threats, for instance. Each individual business has them, and we’ve spotted 1 warning signal for Floor & Decor Holdings you need to know about.

If you like to obtain shares along with management, then you could just like this free listing of corporations. (Hint: insiders have been acquiring them).

You should notice, the sector returns quoted in this posting mirror the market place weighted average returns of shares that at present trade on US exchanges.

Valuation is complicated, but we’re supporting make it simple.

Uncover out no matter if Flooring & Decor Holdings is most likely about or undervalued by examining out our thorough investigation, which involves fair worth estimates, threats and warnings, dividends, insider transactions and monetary overall health.

Watch the Absolutely free Examination

Have responses on this write-up? Anxious about the written content? Get in touch with us immediately. Alternatively, electronic mail editorial-crew (at) simplywallst.com.

This report by Just Wall St is normal in mother nature. We provide commentary based on historic info and analyst forecasts only working with an impartial methodology and our posts are not meant to be monetary suggestions. It does not constitute a advice to purchase or promote any stock, and does not just take account of your targets, or your financial circumstance. We aim to convey you very long-phrase targeted investigation driven by elementary information. Note that our examination may well not aspect in the latest price tag-sensitive company bulletins or qualitative content. Simply Wall St has no situation in any shares stated.