Capacity Expansions due to Increasing Demand Drive Growth

Global Plywood Market

Dublin, Dec. 12, 2022 (GLOBE NEWSWIRE) — The “Plywood Market by Type (Hardwood and Softwood), Application (Construction and Industrial), Uses Type (New Construction and Rehabilitation), and Region (North America, Europe, APAC, MEA, South America) – Global Forecast to 2027” report has been added to ResearchAndMarkets.com’s offering.

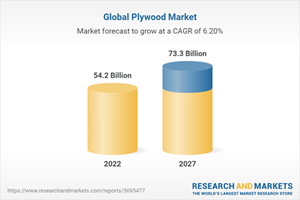

The global plywood market size is projected to grow from USD 54.2 billion in 2022 to USD 73.3 billion by 2027, at a CAGR of 6.2{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}, between 2022 and 2027.

|

Report Attribute |

Details |

|

No. of Pages |

226 |

|

Forecast Period |

2022 – 2027 |

|

Estimated Market Value in 2022 |

54.2 Billion |

|

Forecasted Market Value by 2027 |

73.3 Billion |

|

Compound Annual Growth Rate |

6.2{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} |

|

Regions Covered |

Global |

The hardwood segment is one of the fastest-growing type segments during the forecast period.

Based on type, the hardwood segment is expected to be one of the fastest-growing segments whereas softwood is the largest segment during the forecast period. Hardwood plywood offers a robust, reasonably priced, and ethically produced alternative. Softwood plywood is often used for industrial and construction projects, while Hardwood plywood is typically utilized for items like furniture and cabinets.

Softwood plywood is available in different grades for various applications. Softwood plywood in home construction exists in addition to roofs, walls, and flooring. Plywood is frequently used to cover soffits and eaves. Certain types of plywood, most notably T-111 siding, a grooved sheet product designed to resemble reverse board and batten siding, are produced expressly as siding products.

The rehabilitation segment in uses type is expected to hold the highest growth during the forecast period.

The rehabilitation of buildings is one of the areas with a growing market in multifarious countries, especially in large urban centers where there is a low inventory of land available for new construction. The building rehabilitation and maintenance market is one of the most important economic sectors in construction, especially in the most developed societies.

For instance, Europe is one of the prominent rehabilitation and maintenance markets due to its old infrastructural design. In the United States, this sector also accounts for an important fraction of the construction market.

In addition, there are many other factors that indicate that the rehabilitation market has high growth potential in many countries: the growing social awareness that preservation and enjoyment of the building heritage have acquired, the favorable prospects offered in certain areas by the cultural sector as an engine for activity (cultural tourism), the progressive aging of existing housing, and so forth.

Asia Pacific water storage systems market is estimated to register the highest CAGR during the forecast period.

APAC accounted for a share of 77.0{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of the plywood market in 2021 and is expected to register a CAGR of 6.6{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in terms of value during the forecast period. High economic growth rate, growing manufacturing industries, cheap labor, and global shift of consumption and production capacity from the developed markets to the emerging markets in the region are the factors leading to the growth of the plywood market in the Asia Pacific.

China is the key market in the region, consuming more than half of the demand for plywood. The market in the region is mainly driven by the presence of a large number of leading global plywood companies. China’s wood and wood products industry has a huge influence on the worldwide market as the world’s second-largest wood importer (after the United States) and largest wood product exporter. The annual use of wood is expected to be 550-600 million m3, with building, decorating, paper production, and wood processing (furniture, wood flooring, wood-based panels, and so on) being the main consumers. According to the National Bureau of Statistics (NBS), new dwelling starts fell 11.4 percent in 2021 compared to 2020, and fell even worse in the first four months of 2022, falling 28.4 percent.

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities for Players in Plywood Market

4.2 Plywood Market, by Use Type

4.3 Plywood Market: Developed Vs. Emerging Countries

4.4 Asia-Pacific Plywood Market, by Application and Country, 2021

4.5 Plywood Market, by Major Countries

5 Market Overview

5.1 Introduction

5.2 Market Overview

5.2.1 Drivers

5.2.1.1 Capacity Expansions due to Increasing Demand

5.2.1.2 Significant Growth of Furniture Industry Leading to Rising Demand for Plywood

5.2.1.3 Rising Demand for Plywood in Asia-Pacific due to Growing Building & Construction Industry

5.2.2 Restraints

5.2.2.1 Impact of COVID-19 and Global Economic Crisis

5.2.2.2 Increase in Use of Multiple Byproducts at Economical Cost

5.2.2.3 Gradual Shift in Demand and Production Capacities to Emerging Economies

5.2.3 Opportunities

5.2.3.1 Establishing Authenticity Through Various Certifications

5.2.3.2 Increase in Public-Private Partnerships to Offer Future Revenue Growth Opportunities

5.2.4 Challenges

5.2.4.1 Price Fluctuations and Trade War Between Us and China

5.2.4.2 Low Product Differentiation

5.3 Porter’s Five Forces Analysis

5.4 Key Stakeholders and Buying Criteria

5.5 Macroeconomic Overview and Key Trends

5.6 Value Chain Analysis

5.7 Average Pricing Analysis

5.8 Trade Analysis

5.9 Patent Analysis

5.10 Case Study Analysis

5.10.1 Case Study 1:

5.10.1.1 Title: Roof Decking: Plywood Vs Osb

5.10.2 Case Study 2:

5.10.2.1 Title: Hanson Plywood Case Study – Quality Matters

5.11 Technology Analysis

5.12 Key Conferences & Events in 2023

5.13 Tariff and Regulatory Landscape

6 Plywood Market, by Type

6.1 Introduction

6.2 Hardwood

6.2.1 Utility for High-Traffic Applications Such as Flooring and Furniture

6.3 Softwood

6.3.1 Structural Applications in Building Sector

7 Plywood Market, by Application

7.1 Introduction

7.2 Construction

7.2.1 Roofing

7.2.1.1 Major Component in Construction

7.2.2 Subflooring

7.2.2.1 Extremely Stable Wood Material

7.2.3 Wall Sheathing

7.2.3.1 Provides Strength and Rigidity

7.2.4 Sliding

7.2.4.1 Quick and Ease of Access

7.2.5 Finish Flooring

7.2.5.1 Provides an Advantage Over Hardwood

7.2.6 Other Construction Applications

7.2.6.1 Interior Wall Coverings

7.3 Industrial

7.3.1 Material Handling Products

7.3.1.1 Optimal Material Handling Solutions

7.3.2 Transport Equipment

7.3.2.1 Resistant to Cracking, Breaking, Shrinkage, Twisting, and Warping

7.3.3 Other Industrial Applications

7.3.3.1 Additional Strength and Protection

8 Plywood Market, by Use Type

8.1 Introduction

8.2 New Construction

8.2.1 Economic Recovery and Infrastructure Development in Emerging Economies to Drive New Construction Segment

8.3 Rehabilitation

8.3.1 Sustainability and Aging Infrastructure Expected to Drive Growth

9 Plywood Market, by Region

10 Competitive Landscape

10.1 Overview

10.2 Competitive Leadership Mapping, 2021

10.2.1 Stars

10.2.2 Emerging Leaders

10.2.3 Participants

10.2.4 Pervasive Players

10.3 Sme Matrix, 2021

10.3.1 Responsive Companies

10.3.2 Progressive Companies

10.3.3 Starting Blocks

10.3.4 Dynamic Companies

10.4 Strength of Product Portfolio

10.5 Business Strategy Excellence

10.6 Competitive Benchmarking

10.7 Market Share Analysis

10.8 Market Ranking Analysis

10.9 Revenue Analysis

10.10 Competitive Scenario

10.10.1 Market Evaluation Framework

10.10.2 Market Evaluation Matrix

10.11 Strategic Developments

11 Company Profiles

11.1 Key Players

11.1.1 Georgia-Pacific LLC

11.1.2 Boise Cascade Company

11.1.3 Weyerhaeuser Company Ltd.

11.1.4 Upm-Kymmene Oyj

11.1.5 Sveza Forest Ltd.

11.1.6 Austral Plywoods Pty Ltd.

11.1.7 Potlatchdeltic Corporation

11.1.8 Greenply Industries

11.1.9 Metsa Wood (Metsaliitto Cooperative)

11.1.10 Century Plyboards Ltd.

11.2 Other Players

11.2.1 Austin Plywood

11.2.2 Latvijas Finieris As

11.2.3 Kitply Industries Limited

11.2.4 Kajaria Plywood Pvt. Ltd.

11.2.5 Merino Industries Limited

11.2.6 Globe Panel Industries

11.2.7 Uniply Industries Ltd.

11.2.8 Duroply Industries Limited

11.2.9 Ufp Industries, Inc.

11.2.10 Murphy Plywood

11.2.11 West Fraser Timber Co. Ltd.

11.2.12 Royomartin

11.2.13 Formwood Industries

11.2.14 Archela Contrachapados Sl

11.2.15 Miraluz Industry and Wood Ltda.

12 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/ip3jch

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900