With Floor & Decor Holdings, Inc.’s (NYSE:FND)) price down 11{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} this week, insiders might find some solace having sold US$8.8m worth of shares earlier this year.

Insiders appear to have produced the most of their holdings by marketing US$8.8m truly worth of Ground & Decor Holdings, Inc. (NYSE:FND) inventory at an average offer cost of US$123 during the earlier 12 months. The company’s marketplace cap plunged by US$800m following price tag dropped by 11{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} very last week but insiders were ready to restrict their reduction to an extent.

Although insider transactions are not the most essential thing when it arrives to very long-phrase investing, logic dictates you need to pay back some awareness to irrespective of whether insiders are purchasing or promoting shares.

Check out our latest investigation for Flooring & Decor Holdings

Floor & Decor Holdings Insider Transactions Above The Previous Year

The Impartial Chairman of the Board, Norman Axelrod, produced the most important insider sale in the final 12 months. That one transaction was for US$4.8m value of shares at a value of US$121 each individual. We commonly really don’t like to see insider providing, but the reduce the sale price tag, the extra it problems us. It truly is of some comfort that this sale was carried out at a cost perfectly higher than the present-day share value, which is US$63.54. So it might not drop much gentle on insider self-confidence at latest ranges.

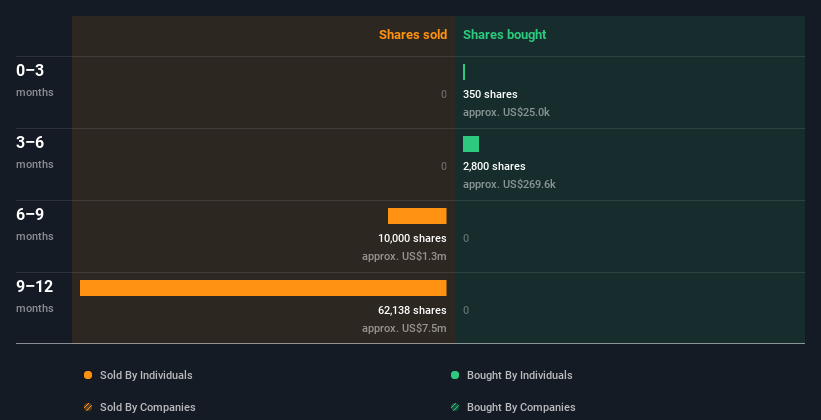

Happily, we be aware that in the final 12 months insiders paid US$294k for 3.15k shares. On the other hand they divested 72.14k shares, for US$8.8m. In whole, Flooring & Decor Holdings insiders offered much more than they purchased in excess of the very last calendar year. The chart under exhibits insider transactions (by corporations and folks) about the last 12 months. By clicking on the graph underneath, you can see the specific details of each and every insider transaction!

For these who like to come across profitable investments this absolutely free record of increasing corporations with modern insider purchasing, could be just the ticket.

Floor & Decor Holdings Insiders Acquired Stock Not too long ago

We observed some Floor & Decor Holdings insider obtaining shares in the final a few months. Independent Director Ryan Marshall shelled out US$25k for shares in that time. It’s superior to see the insider buying, as effectively as the absence of new sellers. But the quantity invested in the previous 3 months isn’t really adequate for us as well set considerably body weight on it, as a solitary issue.

Insider Ownership

For a common shareholder, it is truly worth examining how many shares are held by business insiders. Generally, the larger the insider ownership, the extra most likely it is that insiders will be incentivised to develop the firm for the very long term. It is good to see that Ground & Decor Holdings insiders own 1.9{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of the enterprise, worth about US$126m. I like to see this degree of insider possession, since it raises the probabilities that administration are thinking about the very best pursuits of shareholders.

So What Do The Flooring & Decor Holdings Insider Transactions Reveal?

We take note a that there has been a bit of insider shopping for not long ago (but no promoting). That claimed, the purchases were not substantial. It is really heartening that insiders very own lots of inventory, but we would like to see much more insider purchasing, due to the fact the past 12 months of Ground & Decor Holdings insider transactions will not fill us with self-confidence. So these insider transactions can enable us build a thesis about the inventory, but it’s also worthwhile understanding the challenges experiencing this organization. To assist with this, we have uncovered 2 warning signs (1 tends to make us a little bit not comfortable!) that you should to be mindful of right before getting any shares in Ground & Decor Holdings.

Of program, you might discover a fantastic financial investment by wanting somewhere else. So just take a peek at this free checklist of interesting companies.

For the needs of this article, insiders are these persons who report their transactions to the applicable regulatory entire body. We now account for open up market place transactions and personal inclinations, but not by-product transactions.

Have opinions on this write-up? Involved about the content material? Get in touch with us instantly. Alternatively, email editorial-staff (at) simplywallst.com.

This article by Simply just Wall St is common in mother nature. We provide commentary centered on historical knowledge and analyst forecasts only employing an unbiased methodology and our content are not supposed to be monetary information. It does not represent a suggestion to get or provide any inventory, and does not choose account of your targets, or your fiscal circumstance. We aim to convey you very long-term concentrated evaluation driven by fundamental facts. Be aware that our analysis may not component in the latest value-delicate organization announcements or qualitative material. Merely Wall St has no place in any stocks pointed out.