We Think Floor & Decor Holdings (NYSE:FND) Can Stay On Top Of Its Debt

David Iben place it very well when he mentioned, ‘Volatility is not a threat we treatment about. What we care about is keeping away from the long term decline of capital.’ When we think about how risky a corporation is, we constantly like to look at its use of personal debt, since debt overload can guide to wreck. We can see that Flooring & Decor Holdings, Inc. (NYSE:FND) does use personal debt in its business enterprise. But ought to shareholders be worried about its use of credit card debt?

When Is Financial debt Unsafe?

Personal debt and other liabilities grow to be risky for a company when it are unable to simply satisfy people obligations, possibly with absolutely free dollars flow or by boosting funds at an desirable price tag. Component and parcel of capitalism is the procedure of ‘creative destruction’ the place unsuccessful businesses are mercilessly liquidated by their bankers. Having said that, a a lot more repeated (but however costly) prevalence is the place a enterprise have to issue shares at deal-basement selling prices, completely diluting shareholders, just to shore up its balance sheet. By changing dilution, however, debt can be an extremely good resource for corporations that require funds to make investments in growth at higher prices of return. The first move when thinking about a company’s debt stages is to take into account its money and financial debt with each other.

See our most current assessment for Flooring & Decor Holdings

What Is Flooring & Decor Holdings’s Internet Credit card debt?

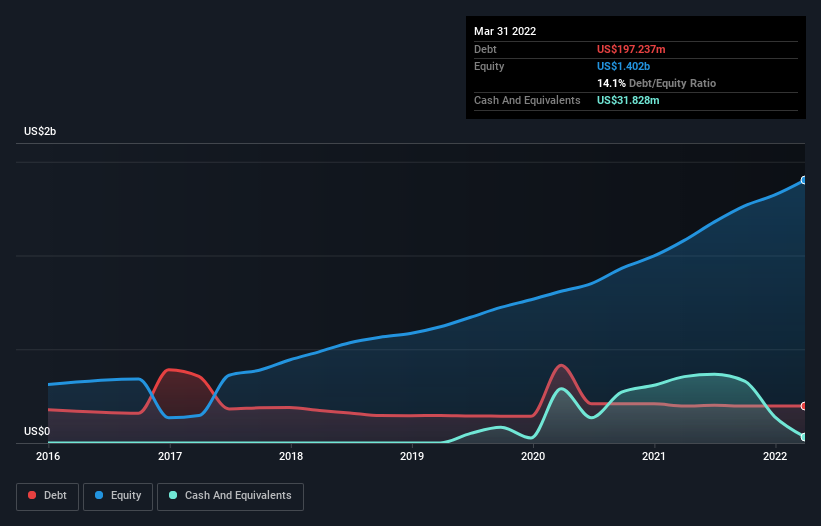

The chart beneath, which you can click on on for greater element, displays that Flooring & Decor Holdings experienced US$197.2m in debt in March 2022 about the exact same as the yr in advance of. On the other hand, it does have US$31.8m in cash offsetting this, major to web personal debt of about US$165.4m.

A Appear At Flooring & Decor Holdings’ Liabilities

We can see from the most new balance sheet that Ground & Decor Holdings had liabilities of US$1.09b falling owing within just a yr, and liabilities of US$1.40b owing further than that. Offsetting these obligations, it experienced cash of US$31.8m as effectively as receivables valued at US$97.8m due inside of 12 months. So its liabilities outweigh the sum of its cash and (in close proximity to-time period) receivables by US$2.36b.

This deficit is just not so lousy since Ground & Decor Holdings is worthy of US$8.16b, and therefore could likely elevate plenty of funds to shore up its harmony sheet, if the need arose. Even so, it is nevertheless worthwhile having a near search at its ability to spend off debt.

We use two main ratios to notify us about credit card debt ranges relative to earnings. The initial is net personal debt divided by earnings just before curiosity, tax, depreciation, and amortization (EBITDA), when the second is how numerous times its earnings ahead of interest and tax (EBIT) addresses its fascination expenditure (or its curiosity deal with, for limited). The gain of this solution is that we choose into account the two the absolute quantum of credit card debt (with net personal debt to EBITDA) and the true desire bills related with that credit card debt (with its desire address ratio).

Floor & Decor Holdings has a very low web financial debt to EBITDA ratio of only .36. And its EBIT covers its interest expenditure a whopping 72.2 situations above. So we are pretty comfortable about its super-conservative use of debt. Yet another good sign is that Floor & Decor Holdings has been able to enhance its EBIT by 30{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in twelve months, earning it a lot easier to pay out down personal debt. When analysing personal debt stages, the balance sheet is the apparent position to start. But finally the foreseeable future profitability of the business will determine if Flooring & Decor Holdings can reinforce its harmony sheet around time. So if you might be focused on the future you can examine out this absolutely free report showing analyst gain forecasts.

At last, a small business requirements totally free income flow to pay out off personal debt accounting gains just don’t slice it. So the reasonable stage is to glance at the proportion of that EBIT that is matched by true cost-free income flow. Considering the very last 3 years, Floor & Decor Holdings actually recorded a funds outflow, all round. Financial debt is considerably more dangerous for providers with unreliable free income move, so shareholders need to be hoping that the previous expenditure will make totally free money stream in the future.

Our See

Fortunately, Ground & Decor Holdings’s spectacular interest deal with indicates it has the upper hand on its debt. But we should concede we discover its conversion of EBIT to absolutely free hard cash move has the reverse effect. All these things deemed, it appears that Flooring & Decor Holdings can easily manage its latest personal debt amounts. On the moreover side, this leverage can enhance shareholder returns, but the prospective draw back is far more possibility of decline, so it can be worthy of monitoring the stability sheet. When analysing credit card debt degrees, the equilibrium sheet is the clear put to begin. Nonetheless, not all investment threat resides in just the harmony sheet – far from it. To that conclusion, you need to discover about the 2 warning indicators we’ve spotted with Ground & Decor Holdings (which includes 1 which can not be ignored) .

If you are interested in investing in organizations that can mature gains devoid of the burden of personal debt, then check out this totally free record of expanding organizations that have web money on the balance sheet.

Have feed-back on this posting? Involved about the content material? Get in contact with us right. Alternatively, e-mail editorial-group (at) simplywallst.com.

This short article by Just Wall St is normal in character. We give commentary centered on historic info and analyst forecasts only utilizing an unbiased methodology and our articles are not meant to be monetary information. It does not represent a advice to get or offer any stock, and does not take account of your goals, or your financial scenario. We intention to carry you very long-time period centered assessment pushed by basic info. Note that our assessment could not factor in the latest rate-sensitive enterprise bulletins or qualitative substance. Merely Wall St has no place in any shares stated.