These 4 Measures Indicate That Floor & Decor Holdings (NYSE:FND) Is Using Debt Reasonably Well

Warren Buffett famously mentioned, ‘Volatility is much from synonymous with danger.’ So it would seem the sensible dollars knows that debt – which is typically concerned in bankruptcies – is a extremely critical factor, when you assess how dangerous a business is. We can see that Floor & Decor Holdings, Inc. (NYSE:FND) does use financial debt in its enterprise. But is this credit card debt a worry to shareholders?

What Chance Does Financial debt Deliver?

Financial debt and other liabilities come to be risky for a small business when it are not able to simply satisfy individuals obligations, possibly with totally free income movement or by increasing funds at an desirable rate. In the long run, if the firm cannot fulfill its authorized obligations to repay debt, shareholders could stroll absent with nothing at all. Nonetheless, a extra regular (but nevertheless high-priced) problem is in which a company have to dilute shareholders at a inexpensive share selling price just to get personal debt less than management. By replacing dilution, although, credit card debt can be an exceptionally good software for firms that want capital to invest in progress at significant rates of return. The initially stage when considering a firm’s credit card debt ranges is to consider its money and debt with each other.

See our most current evaluation for Flooring & Decor Holdings

What Is Flooring & Decor Holdings’s Debt?

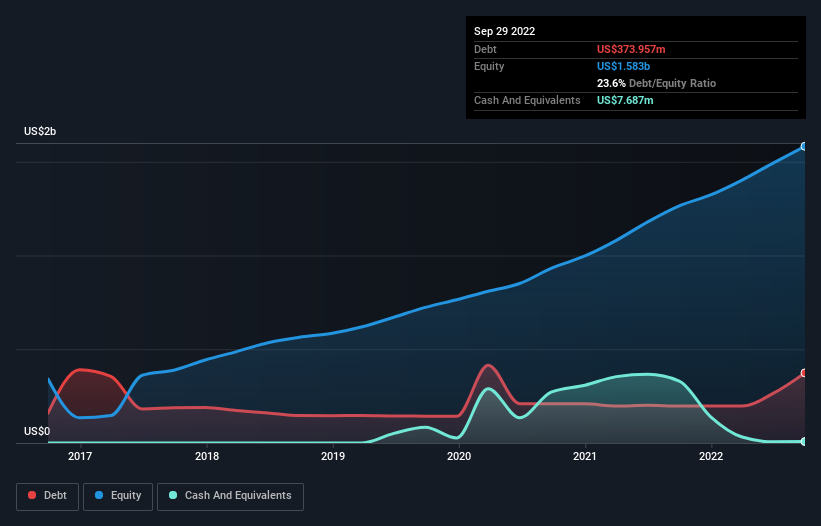

As you can see beneath, at the end of September 2022, Ground & Decor Holdings experienced US$374.0m of debt, up from US$197.4m a yr ago. Click on the picture for more element. Nevertheless, it does have US$7.69m in dollars offsetting this, top to web personal debt of about US$366.3m.

How Powerful Is Floor & Decor Holdings’ Equilibrium Sheet?

We can see from the most the latest equilibrium sheet that Ground & Decor Holdings experienced liabilities of US$1.06b slipping thanks within just a 12 months, and liabilities of US$1.60b because of beyond that. Offsetting these obligations, it had hard cash of US$7.69m as properly as receivables valued at US$112.4m due within 12 months. So it has liabilities totalling US$2.54b extra than its hard cash and near-phrase receivables, put together.

Floor & Decor Holdings has a market capitalization of US$9.00b, so it could quite likely increase funds to ameliorate its stability sheet, if the require arose. Nonetheless, it is nonetheless worthwhile taking a near glance at its potential to fork out off financial debt.

We measure a firm’s credit card debt load relative to its earnings power by wanting at its net credit card debt divided by its earnings in advance of interest, tax, depreciation, and amortization (EBITDA) and by calculating how very easily its earnings ahead of interest and tax (EBIT) go over its fascination expenditure (curiosity go over). This way, we take into account both the complete quantum of the financial debt, as properly as the fascination rates paid out on it.

Flooring & Decor Holdings has a small web personal debt to EBITDA ratio of only .71. And its EBIT handles its curiosity price a whopping 52.5 moments over. So you could argue it is no additional threatened by its personal debt than an elephant is by a mouse. Fortuitously, Floor & Decor Holdings grew its EBIT by 6.2{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in the very last calendar year, earning that debt load look even additional workable. The balance sheet is obviously the spot to emphasis on when you are analysing personal debt. But it is foreseeable future earnings, more than just about anything, that will decide Flooring & Decor Holdings’s ability to retain a healthy equilibrium sheet heading forward. So if you are concentrated on the potential you can examine out this no cost report demonstrating analyst financial gain forecasts.

Eventually, though the tax-guy may well adore accounting revenue, loan companies only settle for chilly tough income. So we clearly need to have to appear at whether that EBIT is main to corresponding absolutely free funds flow. In the course of the past three years, Floor & Decor Holdings burned a ton of cash. Though investors are no doubt expecting a reversal of that condition in thanks system, it plainly does mean its use of debt is more risky.

Our Look at

Based mostly on what we have observed Flooring & Decor Holdings is not discovering it uncomplicated, specified its conversion of EBIT to free of charge funds movement, but the other components we considered give us result in to be optimistic. In individual, we are dazzled with its interest include. When we take into consideration all the factors pointed out higher than, we do feel a little bit careful about Floor & Decor Holdings’s use of financial debt. Even though we value financial debt can enrich returns on equity, we would advise that shareholders retain near look at on its debt degrees, lest they maximize. The stability sheet is plainly the place to concentrate on when you are analysing debt. But ultimately, every single business can have threats that exist outside of the harmony sheet. Be knowledgeable that Flooring & Decor Holdings is exhibiting 1 warning sign in our investment decision analysis , you must know about…

At the finish of the day, it is really often much better to target on firms that are no cost from internet personal debt. You can entry our unique record of these businesses (all with a monitor file of profit advancement). It can be no cost.

What are the risks and possibilities for Floor & Decor Holdings?

Ground & Decor Holdings, Inc. operates as a multi-channel specialty retailer and professional flooring distributor of really hard surface flooring and linked accessories.

View Entire Assessment

Have feed-back on this article? Concerned about the information? Get in touch with us right. Alternatively, e-mail editorial-workforce (at) simplywallst.com.

This article by Simply Wall St is general in nature. We supply commentary primarily based on historic information and analyst forecasts only employing an impartial methodology and our content are not intended to be money suggestions. It does not represent a advice to get or market any stock, and does not acquire account of your targets, or your economic situation. We aim to deliver you lengthy-phrase focused assessment pushed by elementary details. Note that our investigation may possibly not aspect in the most recent value-delicate corporation announcements or qualitative materials. Simply Wall St has no placement in any shares pointed out.