Some Investors May Be Worried About Floor & Decor Holdings’ (NYSE:FND) Returns On Capital

To come across a multi-bagger stock, what are the underlying traits we must seem for in a organization? Amongst other issues, we’ll want to see two factors first of all, a rising return on capital used (ROCE) and secondly, an enlargement in the firm’s total of funds employed. Fundamentally this signifies that a business has rewarding initiatives that it can continue on to reinvest in, which is a trait of a compounding machine. Even so, after briefly looking above the quantities, we will not assume Flooring & Decor Holdings (NYSE:FND) has the makings of a multi-bagger likely forward, but let’s have a seem at why that may possibly be.

What Is Return On Money Utilized (ROCE)?

Just to explain if you happen to be unsure, ROCE is a metric for analyzing how much pre-tax revenue (in proportion conditions) a corporation earns on the cash invested in its enterprise. The system for this calculation on Flooring & Decor Holdings is:

Return on Cash Utilized = Earnings Before Interest and Tax (EBIT) ÷ (Whole Belongings – Recent Liabilities)

.12 = US$367m ÷ (US$4.2b – US$1.1b) (Centered on the trailing twelve months to September 2022).

So, Flooring & Decor Holdings has an ROCE of 12{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}. In isolation, that is a really standard return but versus the Specialty Retail business normal of 17{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}, it can be not as excellent.

View our newest investigation for Ground & Decor Holdings

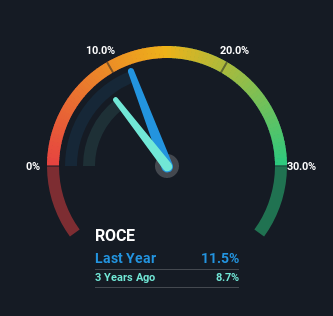

Above you can see how the current ROCE for Floor & Decor Holdings compares to its prior returns on funds, but there is certainly only so considerably you can convey to from the past. If you are fascinated, you can see the analysts predictions in our no cost report on analyst forecasts for the firm.

What Does the ROCE Trend For Floor & Decor Holdings Convey to Us?

On the surface area, the pattern of ROCE at Floor & Decor Holdings doesn’t encourage self-assurance. Around 5 yrs back the returns on cash were 16{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}, but considering the fact that then they’ve fallen to 12{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}. Nevertheless, offered capital used and earnings have equally elevated it seems that the business enterprise is presently pursuing development, at the consequence of brief time period returns. If these investments prove productive, this can bode incredibly well for long term inventory functionality.

In Summary…

Even nevertheless returns on capital have fallen in the brief phrase, we discover it promising that revenue and funds utilized have equally greater for Flooring & Decor Holdings. And the stock has carried out extremely effectively with a 107{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} return in excess of the last five years, so very long phrase buyers are no question ecstatic with that consequence. So though the underlying tendencies could by now be accounted for by buyers, we nonetheless think this inventory is truly worth hunting into even more.

If you’d like to know about the pitfalls dealing with Floor & Decor Holdings, we have learned 1 warning indication that you should be knowledgeable of.

Though Floor & Decor Holdings may well not at the moment generate the greatest returns, we’ve compiled a record of companies that now generate extra than 25{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} return on fairness. Examine out this absolutely free record listed here.

Valuation is advanced, but we’re serving to make it straightforward.

Locate out irrespective of whether Flooring & Decor Holdings is possibly over or undervalued by examining out our thorough evaluation, which incorporates reasonable worth estimates, risks and warnings, dividends, insider transactions and money health.

Look at the Free of charge Examination

Have opinions on this short article? Involved about the written content? Get in touch with us directly. Alternatively, e mail editorial-workforce (at) simplywallst.com.

This posting by Basically Wall St is normal in nature. We present commentary primarily based on historic facts and analyst forecasts only using an unbiased methodology and our articles or blog posts are not supposed to be monetary suggestions. It does not constitute a suggestion to acquire or market any inventory, and does not get account of your targets, or your money condition. We intention to carry you long-phrase focused investigation pushed by fundamental info. Notice that our investigation may possibly not issue in the most up-to-date price tag-sensitive company bulletins or qualitative content. Basically Wall St has no situation in any shares stated.