Is It Time To Consider Buying Floor & Decor Holdings, Inc. (NYSE:FND)?

Ground & Decor Holdings, Inc. (NYSE:FND), may well not be a big cap stock, but it led the NYSE gainers with a relatively huge price hike in the previous pair of weeks. As a mid-cap inventory with high protection by analysts, you could presume any recent modifications in the company’s outlook is now priced into the stock. But what if there is nevertheless an possibility to acquire? Let’s consider a glimpse at Ground & Decor Holdings’s outlook and worth centered on the most modern financial knowledge to see if the chance continue to exists.

See our most recent investigation for Flooring & Decor Holdings

What is Ground & Decor Holdings well worth?

In accordance to my cost several design, in which I compare the company’s value-to-earnings ratio to the field typical, the inventory at the moment appears highly-priced. In this instance, I’ve utilized the rate-to-earnings (PE) ratio provided that there is not more than enough data to reliably forecast the stock’s dollars flows. I discover that Floor & Decor Holdings’s ratio of 28.28x is earlier mentioned its peer common of 5.79x, which indicates the inventory is investing at a greater selling price compared to the Specialty Retail industry. If you like the stock, you may well want to preserve an eye out for a probable price tag decline in the long run. Due to the fact Floor & Decor Holdings’s share price tag is really volatile, this could indicate it can sink reduced (or rise even further more) in the foreseeable future, giving us a further chance to devote. This is centered on its superior beta, which is a fantastic indicator for how much the stock moves relative to the rest of the industry.

Can we anticipate growth from Flooring & Decor Holdings?

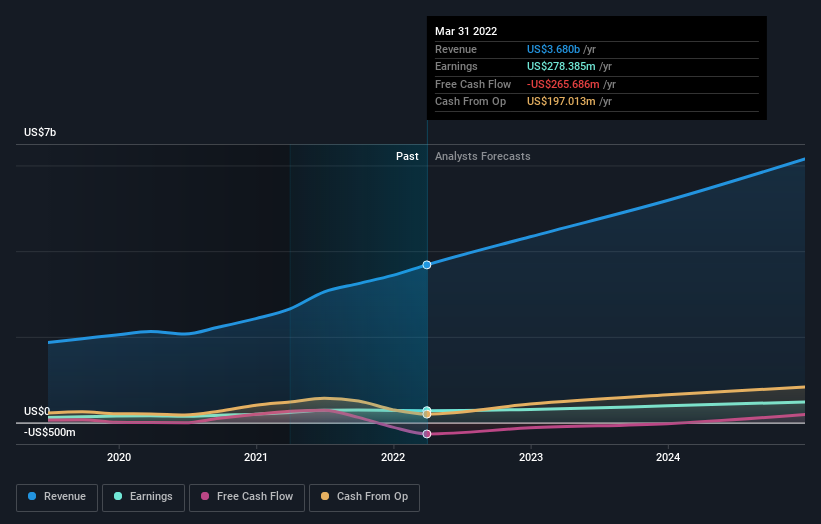

Traders seeking for progress in their portfolio could want to take into consideration the prospective clients of a organization prior to purchasing its shares. Despite the fact that benefit buyers would argue that it’s the intrinsic benefit relative to the rate that matter the most, a extra persuasive financial investment thesis would be superior expansion probable at a low cost cost. Floor & Decor Holdings’ earnings above the upcoming number of a long time are predicted to increase by 80{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}, indicating a really optimistic long run forward. This should lead to more strong cash flows, feeding into a increased share price.

What this suggests for you:

Are you a shareholder? FND’s optimistic upcoming growth appears to have been factored into the present share value, with shares trading above industry cost multiples. Having said that, this brings up a different problem – is now the ideal time to market? If you imagine FND must trade beneath its present price, promoting superior and shopping for it back up all over again when its cost falls in direction of the field PE ratio can be profitable. But prior to you make this final decision, choose a glance at no matter whether its fundamentals have changed.

Are you a potential investor? If you’ve been preserving tabs on FND for some time, now might not be the ideal time to enter into the stock. The value has surpassed its business peers, which means it is probable that there is no far more upside from mispricing. Nonetheless, the favourable outlook is encouraging for FND, which implies it’s value diving further into other factors in purchase to take gain of the following selling price drop.

So if you’d like to dive deeper into this inventory, it really is very important to contemplate any challenges it truly is struggling with. Situation in place: We have noticed 1 warning indication for Flooring & Decor Holdings you need to be conscious of.

If you are no for a longer time intrigued in Ground & Decor Holdings, you can use our free of charge system to see our listing of over 50 other stocks with a substantial growth prospective.

Have responses on this write-up? Involved about the information? Get in touch with us instantly. Alternatively, e-mail editorial-crew (at) simplywallst.com.

This report by Just Wall St is general in character. We provide commentary based on historical knowledge and analyst forecasts only utilizing an unbiased methodology and our article content are not supposed to be financial suggestions. It does not represent a suggestion to get or sell any inventory, and does not acquire account of your goals, or your monetary predicament. We intention to provide you very long-expression targeted examination pushed by elementary info. Take note that our investigation could not component in the latest selling price-sensitive company bulletins or qualitative product. Merely Wall St has no position in any stocks described.