Insiders who sold Floor & Decor Holdings, Inc.’s (NYSE:FND) earlier year may find some solace in the 5.9{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} drop

Even however Floor & Decor Holdings, Inc. (NYSE:FND) has fallen by 5.9{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} more than the previous 7 days , insiders who sold US$2.4m worthy of of inventory around the previous yr have had considerably less luck. Insiders would almost certainly have been much better off holding on to their shares offered that the normal promoting cost of US$91.96 is even now decreased than the present-day share selling price.

Whilst insider transactions are not the most crucial detail when it comes to very long-phrase investing, we would contemplate it silly to overlook insider transactions altogether.

Examine out our latest analysis for Floor & Decor Holdings

Flooring & Decor Holdings Insider Transactions Over The Last 12 months

More than the previous yr, we can see that the most significant insider sale was by the Executive Vice President of Business enterprise Progress Strategy, Brian Robbins, for US$1.8m value of shares, at about US$91.82 per share. So it truly is apparent an insider preferred to take some income off the desk, even a bit beneath the present-day price tag of US$92.38. As a basic rule we consider it to be discouraging when insiders are selling down below the current price tag, due to the fact it suggests they have been content with a lower valuation. On the other hand, even though insider promoting is from time to time discouraging, it truly is only a weak sign. This single sale was 63{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of Brian Robbins’s stake.

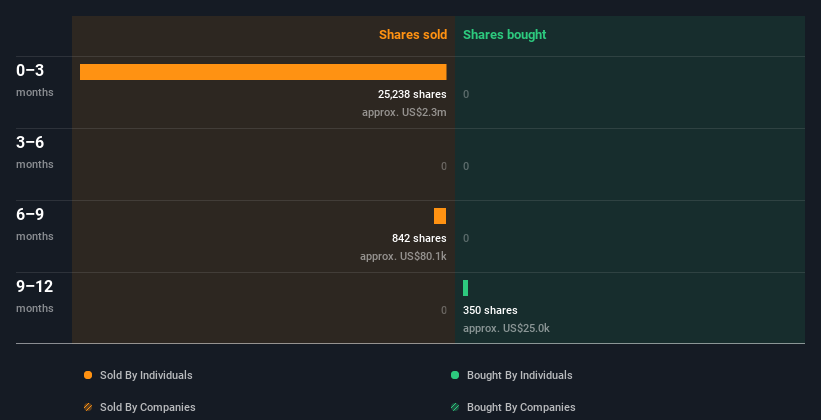

All up, insiders offered a lot more shares in Ground & Decor Holdings than they acquired, more than the previous 12 months. You can see the insider transactions (by corporations and men and women) above the final calendar year depicted in the chart down below. By clicking on the graph below, you can see the specific details of just about every insider transaction!

I will like Floor & Decor Holdings improved if I see some massive insider buys. When we hold out, verify out this totally free listing of developing companies with substantial, latest, insider getting.

Flooring & Decor Holdings Insiders Are Providing The Inventory

The last 3 months saw major insider selling at Flooring & Decor Holdings. In overall, insiders dumped US$2.3m worthy of of shares in that time, and we did not document any buys by any means. Total this helps make us a bit cautious, but it can be not the be all and end all.

Insider Possession Of Ground & Decor Holdings

For a common shareholder, it is well worth checking how quite a few shares are held by business insiders. I reckon it really is a very good indicator if insiders individual a significant amount of shares in the corporation. Floor & Decor Holdings insiders possess about US$174m really worth of shares (which is 1.8{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of the corporation). I like to see this stage of insider possession, mainly because it will increase the odds that administration are imagining about the best interests of shareholders.

So What Does This Information Propose About Flooring & Decor Holdings Insiders?

Insiders sold inventory recently, but they haven’t been obtaining. Zooming out, the lengthier term picture doesn’t give us a great deal convenience. On the plus side, Ground & Decor Holdings can make dollars, and is rising income. Whilst insiders do individual a large amount of shares in the firm (which is fantastic), our examination of their transactions does not make us really feel self-assured about the company. Although we like recognizing what is going on with the insider’s ownership and transactions, we make certain to also take into consideration what hazards are experiencing a stock before producing any financial commitment final decision. Our investigation demonstrates 2 warning signals for Floor & Decor Holdings (1 is a bit about!) and we strongly suggest you look at them prior to investing.

If you would desire to verify out yet another firm — a single with probably excellent financials — then do not miss out on this free of charge list of attention-grabbing firms, that have Substantial return on equity and reduced financial debt.

For the needs of this article, insiders are individuals people who report their transactions to the applicable regulatory human body. We at the moment account for open market transactions and private tendencies, but not spinoff transactions.

Valuation is sophisticated, but we’re aiding make it simple.

Uncover out regardless of whether Ground & Decor Holdings is likely in excess of or undervalued by checking out our detailed analysis, which contains reasonable worth estimates, threats and warnings, dividends, insider transactions and fiscal health and fitness.

Watch the Free of charge Analysis

Have feedback on this post? Concerned about the content? Get in touch with us immediately. Alternatively, e mail editorial-workforce (at) simplywallst.com.

This article by Only Wall St is common in character. We give commentary centered on historical knowledge and analyst forecasts only employing an impartial methodology and our content articles are not supposed to be monetary advice. It does not constitute a advice to get or provide any inventory, and does not just take account of your targets, or your fiscal situation. We aim to deliver you extensive-time period centered analysis pushed by elementary info. Note that our examination may well not issue in the most up-to-date cost-sensitive corporation bulletins or qualitative substance. Simply Wall St has no situation in any shares pointed out.