Home Depot: Buy Gradually On Dips (NYSE:HD)

jetcityimage/iStock Editorial through Getty Images

Introduction

As a dividend expansion trader, I seek out new expense alternatives in money-generating property. When I obtain these assets to be attractively valued, I typically insert to my present positions. Also, I just take edge of sector volatility as we see it now by starting new positions to diversify my holdings and improve my dividend cash flow with a lot less capital.

In the course of a recession like the just one economist forecast, the customer discretionary sector may perhaps underperform as people adhere to their basic costs. It can be an prospect to evaluate businesses in this sector as the weak spot could only be momentary, however the extensive-expression potential customers keep on being intact. A single of these organizations is Residence Depot (NYSE:High definition), which traded for a significant valuation for a extended time.

I will analyze the organization making use of my methodology for analyzing dividend growth stocks. I am employing the similar approach to make it much easier to look at researched businesses. I will study the firm’s fundamentals, valuation, growth options, and risks. I will then try to identify if it is a excellent financial investment.

Trying to get Alpha’s firm overview demonstrates that:

The Dwelling Depot operates as a property improvement retailer. It operates The Residence Depot shops that provide a variety of setting up materials, home advancement solutions, lawn and garden solutions, décor products and solutions, and facilities maintenance, restore, and functions merchandise. The organization also presents installation products and services for flooring, cupboards and cupboard makeovers, countertops, furnaces and central air systems, and windows. In addition, it provides resource and gear rental products and services.

Fundamentals

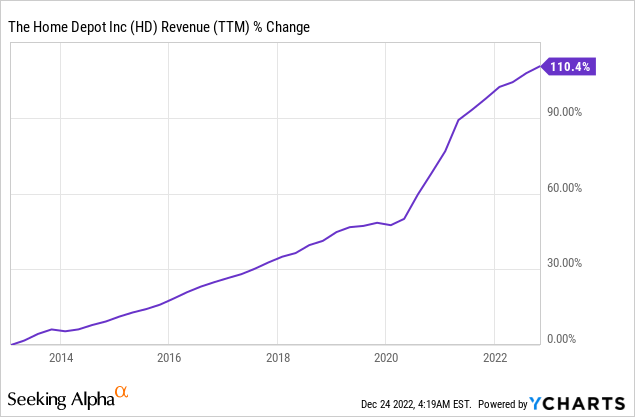

The revenues of Residence Depot have been steadily escalating about the final decade. Sales have a lot more than doubled, which implies they grew at an annual price of practically 8{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}. Sales greater quickly throughout the pandemic as far more people today spent much more time at household. Consequently its physical appearance turned additional crucial for them. In the upcoming, as seen on Seeking Alpha, the analyst consensus expects Home Depot to keep growing income at an annual charge of ~3{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in the medium term.

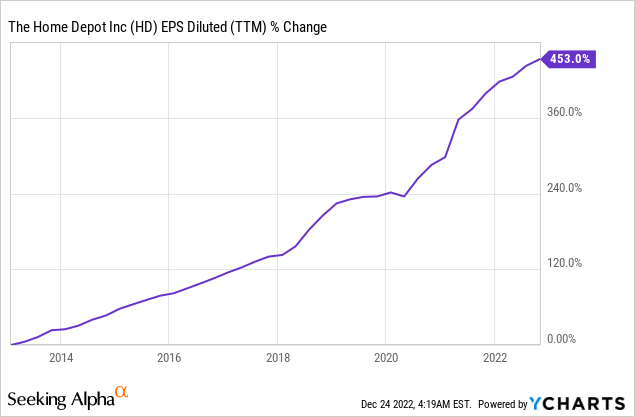

The EPS (earnings for each share) has been developing a lot faster during the similar period of time. The EPS increased by 450{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}, which suggests it is additional than five times higher than it was just a decade ago. The organization realized EPS advancement by escalating profits, shopping for back again its shares, and improving upon margins by earning a much better electronic practical experience and cutting costs. In the long term, as found on In search of Alpha, the analyst consensus expects House Depot to preserve escalating EPS at an once-a-year charge of ~5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in the medium term.

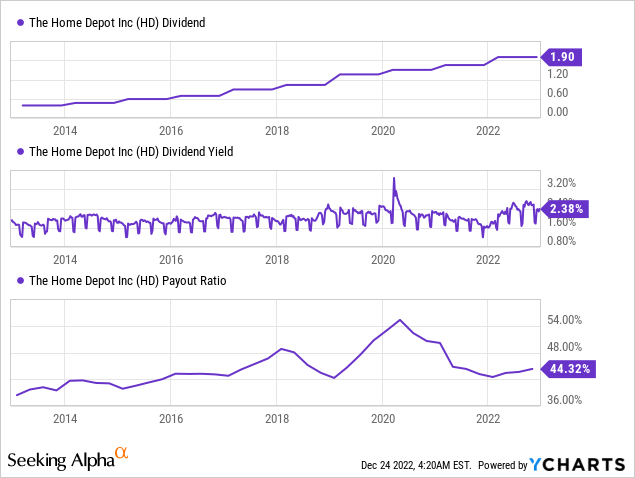

The corporation is a regular dividend payer. It has not decreased the dividend for far more than thirty years and amplified it yearly for 13 many years, together with a 25{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} boost final February. The dividend would seem not likely to be slash as the corporation pays a lot less than 50{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of its EPS. What’s more, the entry generate is higher than its ten-calendar year normal. While the typical advancement price around the last five decades was 18{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}, buyers must count on slower dividend advancement in the medium term, as the EPS expansion is slowing down.

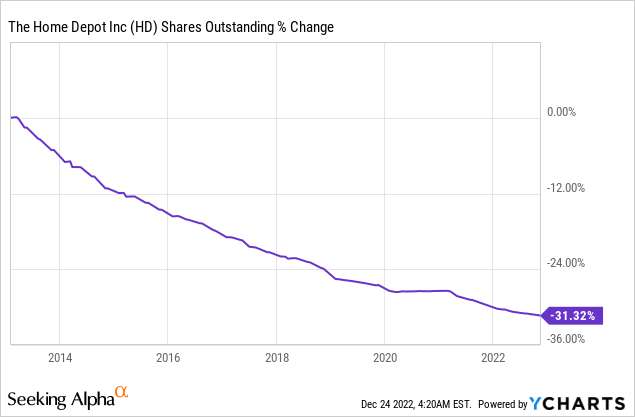

In addition to dividends, corporations like Property Depot reward their shareholders by means of share repurchase programs. Buybacks help EPS expansion about time as they reduced the amount of exceptional shares. House Depot acquired back again just about one particular-third of its shares in the past ten years. Buybacks are hugely successful when shares are attractively valued, and if the volatility persists, it may possibly be an possibility.

Valuation

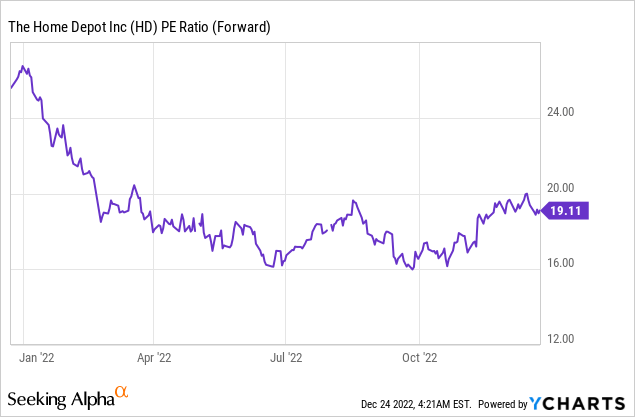

The P/E (price tag to earnings) ratio of the Residence Dept is standing at 19.11 when getting into account the forecasted EPS of the current year. It is reduced at 18.8 when searching at the 2023 EPS forecast. More than the previous twelve months, the valuation has reduced from a P/E ratio of 25 to a minimal of 16. The client discretionary sector tends to be cyclical, so a difficult small business environment has an effect on its valuation swiftly.

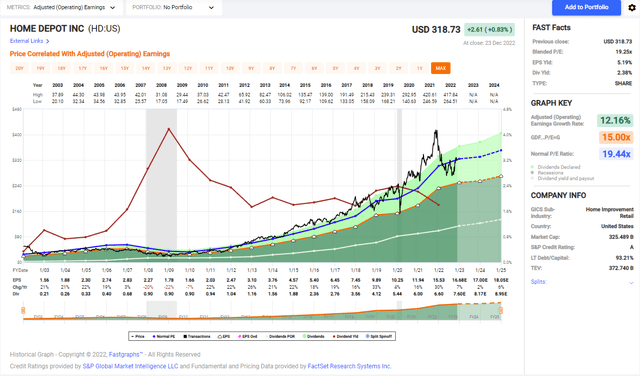

The graph beneath from Fastgraphs demonstrates that Residence Depot is eventually at its historical valuation once more, a unusual event in the very last 5 decades. The existing P/E ratio is like the P/E ratio we have observed in the preceding 20 many years. On the other hand, traders need to also be informed that the forecasted progress charge for the business, which stands at 5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} on a yearly basis, is slower than the 12{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} we saw in the last two many years.

Fastgraphs

Dwelling Depot provides buyers some strong fundamentals with development in product sales, EPS, dividends, and buybacks. The valuation of the inventory is in line with its historical valuation. When it might be tempting to leap into a stock at a historical valuation, it is necessary to cautiously consider the company’s development potential clients and opportunity dangers, as they may have a profound impression on its EPS growth.

Prospects

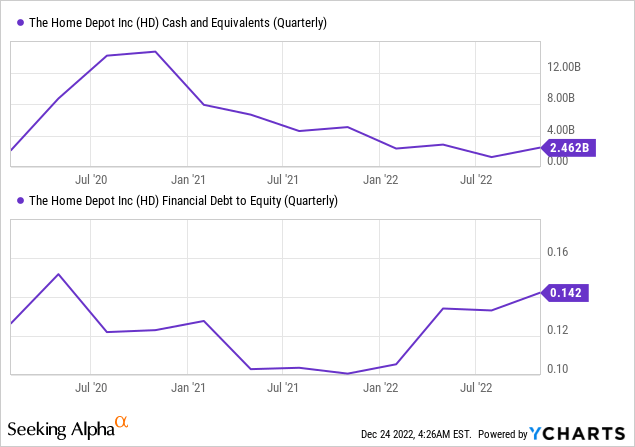

A single option in investing in House Depot is the firm’s reliable financials and market place leadership. Home Depot is the biggest residence improvement retailer in the globe, with a existence in all 50 states and sturdy model recognition. In addition, Residence Depot has a sturdy equilibrium sheet with a minimal personal debt-to-fairness ratio and a strong hard cash posture of more than $2B. These things suggest that the organization is well-positioned to weather financial downturns, continue developing in the long phrase, and it’s possible even obtain some competitors to boost its worth proposition.

A further option in investing in Dwelling Depot is the developing demand from customers for house advancement products and solutions and products and services. The development of householders remaining in their properties more time and investing in residence renovations has been increasing in current several years, primarily mainly because of the pandemic. Even as the financial state is back to usual, we continue to see distant do the job, mastering, and hybrid employment. Far more time at household will see a corresponding enhance in demand for residence advancement items and services. It bodes nicely for Home Depot, as the corporation is properly-positioned to capitalize on this pattern with its vast assortment of solutions and companies.

One more chance in investing in Home Depot is the firm’s diversification. It gives not only merchandise but also the solutions to establish and put in them. It serves both of those end users and gurus who resell it to their purchasers. What’s more, it is growing into new countries these as Canada and Mexico. Featuring more services and items in additional marketplaces with an increasing digital benefit proposition is vital for long run expansion.

Threats

A single risk in investing in House Depot is the potential impact of economic downturns and recessions. Property enhancement jobs are normally regarded as discretionary expending, indicating they could be among the the to start with charges to lower throughout economic uncertainty. If the overall economy were to enter a economic downturn, this could lead to a drop in desire for household improvement solutions and solutions, which could negatively effect Home Depot’s economical efficiency.

A different possibility in investing in House Depot is the competitors from other vendors and on the internet sellers. The property improvement retail market place is remarkably aggressive, with numerous popular national and regional gamers vying for market share, as House Depot has a substantial 18{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} share. In addition, e-commerce has created it less difficult for shoppers to store for house improvement merchandise on the internet, perhaps leading to a drop in store site visitors for House Depot. Property Depot is battling for market share and delivers providers needed to use the products.

In addition to the dangers outlined previously mentioned, one more possibility in investing in Household Depot is the prospective influence of desire costs. Bigger desire premiums can make it extra high priced for customers to finance home enhancement projects, perhaps primary to a decline in demand from customers for the firm’s solutions and providers. It suggests that even if lots of customers have been not impacted by the recession, they may wrestle to finance high priced dwelling renovation tasks. They may perhaps possibly hold off it or shell out time. The two are difficult for Dwelling Depot.

Conclusions

All round, House Depot has sturdy fundamentals, a good valuation, and first rate possibilities for expansion. Having said that, it is crucial to note that the enterprise also faces various dangers, significantly in the quick and medium expression. Investors really should anticipate constant dividend growth, but probably at a slower pace in the coming decades as the corporation sails by a harsher company setting.

Following taking into consideration all of the higher than aspects, I feel that Dwelling Depot is a Hold at the recent time. Buyers should really look at slowly making a placement in the company above time by purchasing on dips. It can enable to regular out the obtain cost and likely mitigate hazard. Score it as a Obtain would have meant that this is an attractive entry selling price. But, with slower progress and unstable markets, I imagine traders should really get progressively. An interesting rate will be a ahead P/E of 14-15, as we have noticed this 12 months.