Floor & Decor: Warren Buffett’s Loading Up On This Undervalued Stock (NYSE:FND)

Vladimir Vladimirov/E+ via Getty Images

The Home Improvement market was one of the “stay at home” industries which boomed during the lockdown of 2020. People have realised the importance of their homes to a greater level, as a place to live, sleep and now work for many. According to one study, the global home improvement market was worth $333 billion in 2021 and is forecasted to grow at a 6.4{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} CAGR, reaching over half a trillion dollars by the end of 2028.

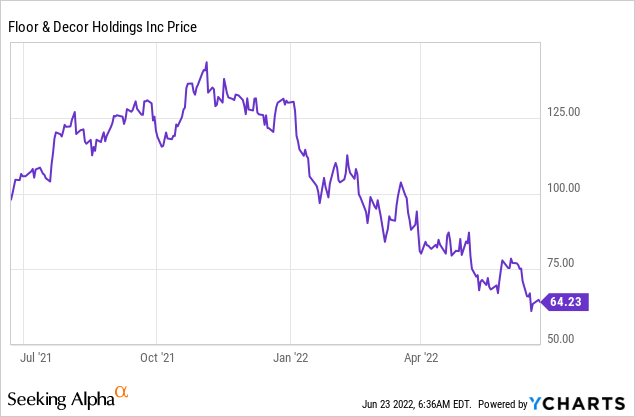

Floor & Decor Holdings (NYSE:FND) is the largest Flooring Retailer in the USA. The company estimates the Total Addressable Market for Hard Surface Flooring and Adjacent Categories is worth over $50 Billion in the USA. The company has achieved 13 consecutive years of sales growth and a staggering 68{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of the U.S. population live within one hour of a Floor & Decor store. The stock price had a tremendous bull run in 2020 and 2021, increasing by over 429{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} from just $27 at the pandemic lows to $143 per share in late October 2021. High inflation numbers released during that date and supply chain disruption have been a catalyst for the stock to give up the majority of its pandemic gains, the stock is now down by -55{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}. My valuation model now shows the stock is substantially undervalued intrinsically. In addition, legendary value investor Warren Buffett of Berkshire Hathaway (BRK.A) was first buying shares of the company in the third quarter of 2021, he then added to his position in the fourth quarter of 2021 and again in the first quarter of 2022, according to the latest SEC filing. Thus, this looks to be a great long-term investment, let’s dive into the business model, financials and valuation for the juicy details.

Solid Business Model

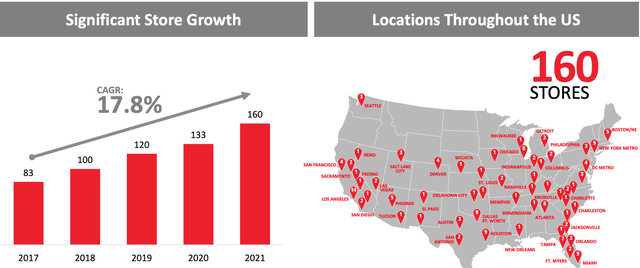

Floor & Decor has 160 stores across 33 states and more square footage dedicated to flooring than anybody else in the industry. While they have bold plans to increase their distribution centers, stores and design studios from “just” 18 million square foot in total to over 29.9 million by 2024. The company focuses on three key customer segments, Homeowners and Pros Active PROs (Professional Member Customers) which total 2.9 million active customers. In addition to commercial customers, which purchase bulk products for real estate development.

Floor & Decor (Investor Day Presentation 2022)

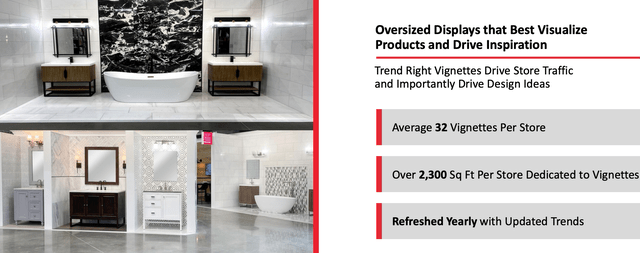

Their stores are dotted with various mock-ups which act as inspiration for customers. This helps to ensure extra purchases from what I like to call the “House Wife Effect” in which someone will see their neighbor has had a new bathroom and then also want one accordingly. The source of this thinking is from anecdotal experience, speaking to various marketing leaders in the home building industry.

Store Displays (Investor Day Presentation)

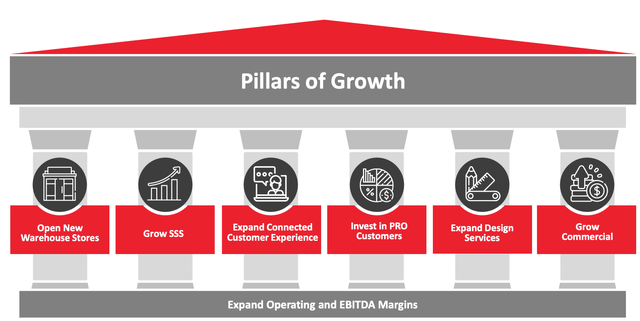

The conversion rate for customers shopping in their stores is over 80{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}, which is incredible and does help to debunk the myth of window shopping. Floor & Decor has five pillars of growth which include opening new warehouse stores (mentioned prior) and expanding their Pro and Commercial customer base. Currently, 59{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of their Active PROs (Professional Member Customers) are enrolled into their Premier Rewards Program and they spend 3x more than Non-PPR PROs. Thus, this offers a significant opportunity for growth and customer retention.

Pillars of Growth (Investor Day Presentation)

Is More Stores the Right Strategy?

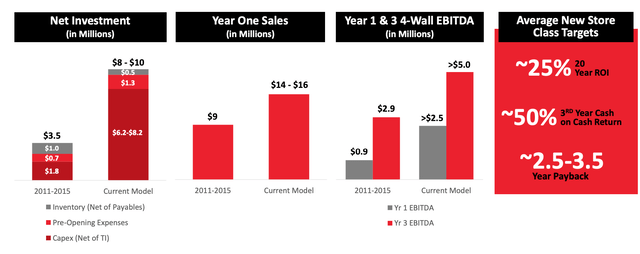

One may say the future of retail is online, however certain industries are less prone to change and these are generally where the products are very large. For example, with flooring many people will want to go and see the product before purchase. The company’s own data backs this up with 71{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of customers who purchase online having been in the store prior. Floor & Decor’s extensive website includes catalogs which can be ordered to your home. In addition, 80{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of customers buy online and pick up in store. Their new store economics also make a lot of sense and according to the company’s data, they achieve a 50{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} 3rd year cash on cash return and a 2.5 to 3.5 year payback.

New Store Economics (Investor Day Presentation)

Growing Financials

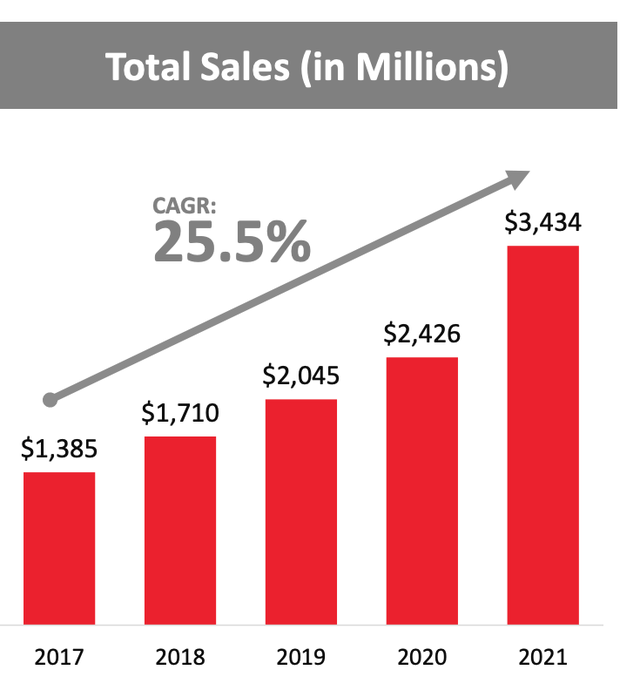

Floor & Decor Holdings has increased its sales at a rapid 25.5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} CAGR over the past 5 years alone. For the first quarter of 2022, this trend has continued with net sales increasing by 28{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} to $1 billion, compared to the same quarter last year, which is great to see. I see no reason why the company cannot continue to replicate this growth through the opening of new stores.

Total Sales (Investor Day Presentation)

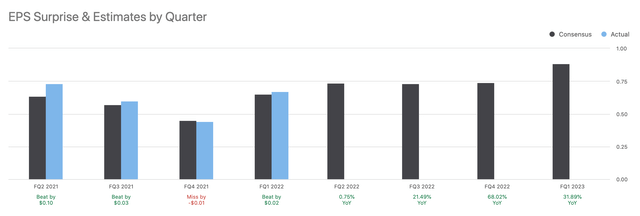

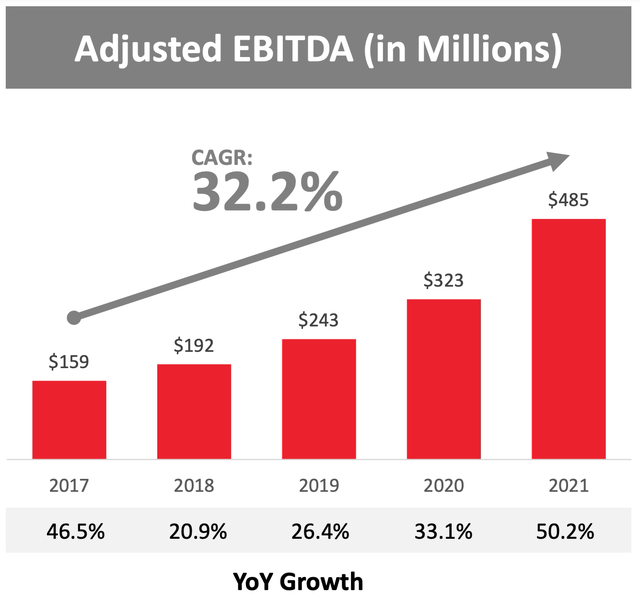

Adjusted EBITDA has grown rapidly with a 32.2{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} CAGR over the past 5 years. While earnings per share (EPS) has also increased by a meteoric 37.1{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} over the past 5 years. For the first quarter of 2022, the company has beat EPS estimates by $0.02, while consensus estimates forecast substantial growth for the rest of 2022.

EPS (Seeking Alpha) Adjusted EBITDA (Investor Day Presentation)

The company’s cash position has decreased substantially from $139.4 million in Q421 to $31.8 million in Q122 as they invest aggressively into opening new stores. Their debt levels are fairly high, but manageable with $195 million in long-term debt.

Valuation

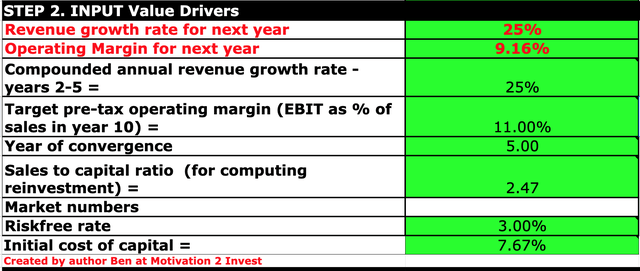

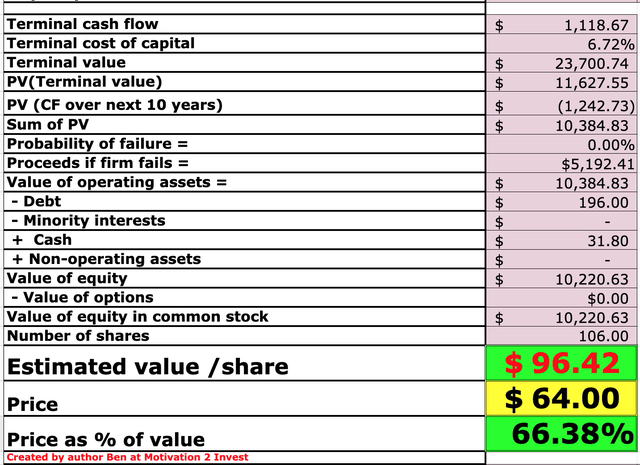

In order to value Floor & Decor, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 25{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} revenue growth for the next 5 years, which is in line with analyst estimates and historic growth rates.

Floor & Decor Stock (created by author Ben at Motivation 2 Invest)

I have predicted margins to expand slightly to 11{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} as the company focuses more on their Pro customers and the design studio upsell opportunities.

Floor & Decor (created by author Ben at Motivation 2 invest)

Given these factors, I get a fair value of $96 per share, the stock is currently trading at $64 and thus is ~44{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} undervalued.

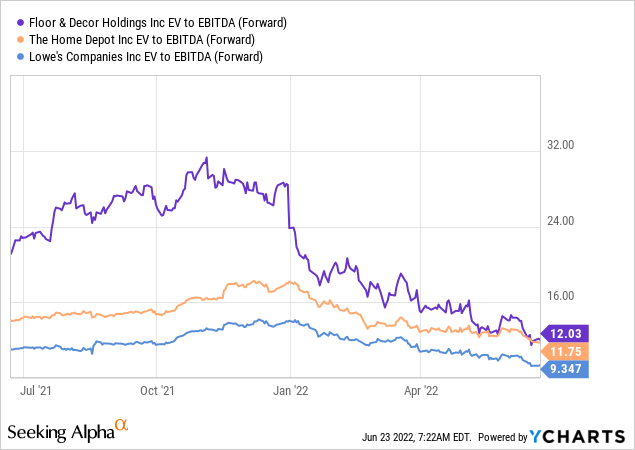

In terms of a relative valuation, Floor & Decor is trading at an EV to EBITDA (forward) = 12, which is lower than historic levels. If I compare to industry peers such as Home Depot (HD) and Lowe’s (LOW), we can see it trades at a slightly higher ratio but not significantly more.

Risks

Brick and Mortar Leases

Floor & Decor’s strategy is to expand aggressively the number of stores they own. Now although they back this up with a sound economic analysis (shown prior), it still is a risk the company is taking given many businesses are opting for a leaner, more online focused business model. The company has $1.15 billion in capital leases and their cash position is much lower than prior.

Material Inflation

The annual inflation rate in the US accelerated to 8.6{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in May 2022, which is the highest since 1981. High inflation increases the input costs for businesses, which includes materials, energy costs for running stores and even labor. If the company is lucky enough to be able to pass these costs onto customers, Economics 101 states, sales will reduce as the goods are mostly elastic with many substitutes. I don’t believe the business has sufficient pricing power as their products are like a commodity, whereas a company such as Apple (AAPL) has an immensely strong brand and thus pricing power.

Final Thoughts

Floor & Decor is a tremendous company, which has generated rapid and consistent revenue growth over the past few years. The company has demonstrated a thorough understanding of their target customer and management backs up all their decisions with sound data and economic analysis, which is great to see. The stock price has recently pulled back substantially and the stock is now undervalued. Value investor Warren Buffett of Berkshire Hathaway has been repeatedly buying shares over the past year and thus this acts as an extra data point of confidence in the stock. Overall, this looks to be a great long-term investment in the future of home improvement.