Floor & Decor: Potential Double In The Next Year (NYSE:FND)

Samantha Ward/iStock by using Getty Images

The modern market malaise has developed so lots of buying chances in great corporations, it has essentially become challenging to pick out between the solutions. I materialize to imagine we have currently noticed the bottom, or we are really near to it, so I’ve been getting on a great deal much more chance in the earlier 7 days or so.

The stocks of corporations that are likely to have recession chance have been destroyed in modern months, even immediately after the beating they took in the initial 5 months of the calendar year. That has produced getting chances that we could not see once more for decades, and I’m on the lookout to just take gain.

One particular these title is Flooring & Décor (NYSE:FND), a main difficult area flooring and accessories in the US. I enjoy the company’s growth story, its management situation in the segment, and now, the valuation. I have been on the sidelines for a long time with FND due to the fact of the valuation, but Mr. Market’s incessant pessimism has dropped a fantastic possibility into the laps of those that want to have a single of the greatest expansion stories in all of retail.

StockCharts

FND has been in a downtrend due to the fact final November, alongside with just about almost everything else that is even remotely advancement-oriented. Nonetheless, it appears to me that the downtrend is ending, and that we are going to appear back on rates in the $60s as a great prospect to obtain.

I have notated a channel that has fashioned this yr making use of the 50-day SMA as the higher bound and the trendline I drew as the reduce. The stock bounced ideal off of that lower trendline previously this 7 days, and I complete anticipate a exam of the 50-day SMA. But that sequence of activities has happened various situations this year, so why is this time distinct?

Initially, momentum is not only not heading decreased, but it is in fact enhancing on this most modern sequence. The PPO is a marvelous medium time period momentum indicator that I use on each chart I look at, and it is due to the fact you can study so much about a stock’s cost action from it. In this case, the PPO showed for lows that had been in virtually exactly the same region when cost designed 4 new lower lows. This most recent lower lower (the fifth a single) was accompanied by a greater reduced in the PPO, indicating bullish momentum is constructing and by extension, advertising stress is abating. Which is exactly what we want to see at a sustainable bottom and I feel we have it.

The accumulation/distribution line is in the same way generating a increased minimal, corresponding to the very same habits in the PPO.

Eventually, one particular piece we are not seeing is relative strength, both from the team or from FND itself. FND has underperformed dwelling enhancement vendors, a team that is dominated by Residence Depot (Hd) and Lowe’s (Lower). Nonetheless, we’ve witnessed a little bit of an uptick in the team since April towards the S&P 500 though marketplace individuals are freaking out about a economic downturn. That tells me these fears are overblown, and that implies there are acquiring chances in the sector. I see FND as one particular of individuals, and likely the ideal a person at the moment.

Progress, growth, and much more development

Now, let us just take a search at some of the expansion FND has viewed in the previous, and what we can count on going ahead. Let’s firs commence with earnings and functioning earnings for the past numerous a long time, both of those in tens of millions of dollars.

TIKR

This is the variety of hockey-adhere formed advancement you want to see from a burgeoning retailer, and FND has it. Admittedly, last year’s income was boosted by pent-up need from COVID lockdowns and stimulus revenue, a confluence of gatherings that designed unbelievable advancement final calendar year. Having said that, we can see in excess of the very long-phrase, this company provides successful profits growth.

This is a rapid overview of the margin condition, which also supports the bull circumstance.

TIKR

Gross margins will not go a ton, which is frequent for home advancement merchants. FND competes in section on rate, so never hope huge motion in gross margins ahead. On the other hand, which is ok because as the enterprise scales its retail store base, matters like SG&A charges are leveraged down, driving operating margin enhancement. That’s what we see listed here, and as we’ll see underneath, you can find additional in which that arrived from.

Now that the historical perspective is established, let us consider a search at what we can hope relocating ahead.

We’ll begin with the shop rely, which is the single major bullish issue from a fundamental viewpoint nowadays.

Investor presentation

The enterprise has about 160 warehouses in the US now, but it not too long ago lifted its prolonged-phrase opportunity to 500 retailers from 400. The firm is only current in 33 states, and in quite a few of those people states, it only has a couple of merchants. The progress probable here is enormous.

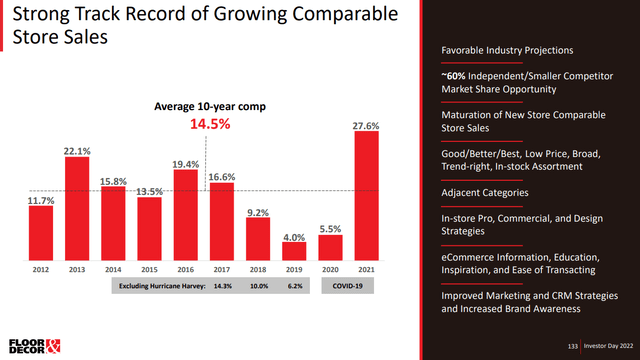

That indicates that FND believes it can 3X its outlets from modern ranges, which should at minimum 3X its earnings. I say “at minimum” simply because FND has a robust heritage of comparable revenue raises, which we can see below.

Trader presentation

Similar gross sales are almost everything to shops, and FND has it, even through 2020. The common 10-year comp acquire is virtually 15{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}, a variety that any retailer would love to have. Comps past 12 months ended up +27.6{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}, which is definitely nowhere near to sustainable, but to its credit rating, estimates for FND’s comps this calendar year and seeking ahead are nevertheless quite optimistic.

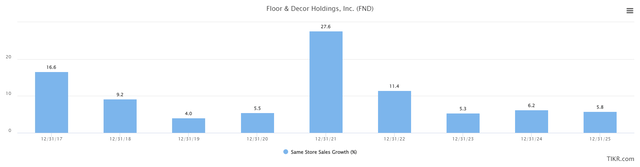

TIKR

Estimates are for +11{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} this calendar year, and ~5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} soon after that. All over again, you will battle to find lots of suppliers with this sort of comp product sales profile, and it is a huge rationale why the inventory was assigned these kinds of superior earnings multiples in the past. If you feel FND’s ability to create comp product sales has not diminished, you probably also believe the higher multiples of the past have a fantastic probability at returning. I do, and that’s a massive explanation why I am so bullish right now. Far more on that in a bit, but let us just take a look at margins and the potential for gains there.

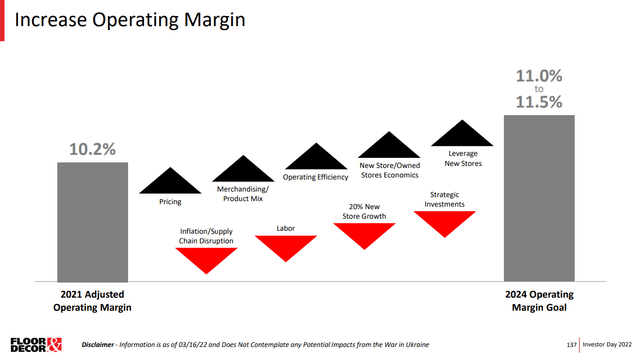

Trader presentation

FND posted modified working margin of 10.2{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of income final calendar year, and it sees medium-expression probable at 11.{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} to 11.5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}. That could not sound like much, but another 80bps to 130bps of profitability on 20{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} profits expansion makes a pretty strong tailwind to earnings. If you think about the corporation is forecasting ~10{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} greater profitability on each dollar of revenue in 2024, that is however a further tailwind to earnings to toss on the pile. Of training course, the organization has to execute to get there on the things it the middle of this chart, but FND’s execution has been exceptional in the past. I have no purpose to feel it won’t go on to operate.

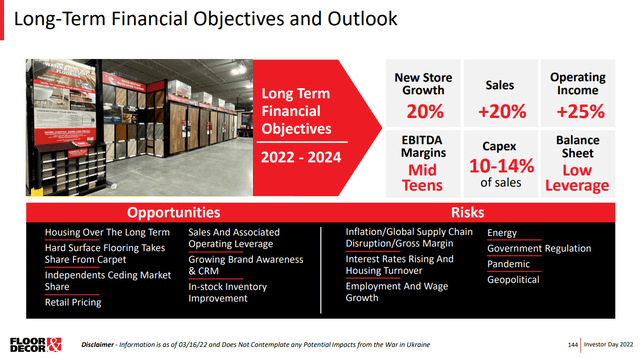

Ultimately, let’s boil all of this down into tangible targets, which the enterprise offers really succinctly in this desk under.

Investor presentation

We are looking at 20{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} keep expansion and 25{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} working cash flow growth, which make whole sense provided the 1) keep depend progress forecasted, 2) equivalent gross sales gains forecasted, and 3) working cash flow gains forecasted for the decades to arrive. These targets, although huge numbers, glance absolutely reasonable. This is not some startup hoping their product catches on FND has many years of shown success and it is basically repeating that product about and about once again.

Trough valuation? Indeed, make sure you

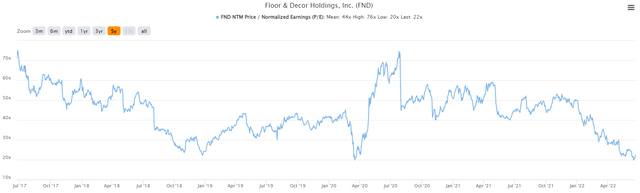

Fears of a recession, as I talked about previously, have pushed the inventory to its least expensive valuation since a very short time period in the course of the COVID worry. We are at 22X ahead earnings today, versus the all-time small of 20X earnings.

TIKR

That in and of by itself makes FND quite enticing, but when we consider the stock’s typical forward P/E ratio in excess of this period is 44X earnings, and the peak was 76X, 22X earnings appears to me like the inventory is pricing in a terrible recession already. What if we never get a awful recession? FND need to see enormous upside from valuation on your own, irrespective of any earnings expansion.

Is FND going to see 76X earnings yet again? Likely not, and I certainly would not personal it at that valuation. But could we see 44X earnings all over again? Totally. The rationale is simply because FND is a person of – or maybe the – best expansion stories in all of retail. That instructions a major a number of, and in my look at, as soon as the fears of economic downturn have handed – both for the reason that there was no economic downturn, or the recession shows indications of ending – FND will be off to the races larger the moment extra.

I see the potential for this inventory to double into 2023 on a valuation reset by yourself, I enjoy the extended-term expansion tale, and the chart is suggesting the stop of the downtrend is nigh. FND is a terrific acquire today.