Floor & Decor Holdings (NYSE:FND) Has A Somewhat Strained Balance Sheet

The external fund supervisor backed by Berkshire Hathaway’s Charlie Munger, Li Lu, will make no bones about it when he says ‘The most important expenditure danger is not the volatility of price ranges, but regardless of whether you will put up with a long lasting loss of money.’ So it would seem the sensible funds knows that personal debt – which is typically involved in bankruptcies – is a incredibly essential element, when you evaluate how dangerous a company is. We take note that Ground & Decor Holdings, Inc. (NYSE:FND) does have personal debt on its harmony sheet. But the extra significant question is: how a great deal possibility is that personal debt building?

When Is Debt A Challenge?

Financial debt and other liabilities turn into risky for a company when it can not easily fulfill those obligations, both with free hard cash circulation or by increasing cash at an desirable price. In the long run, if the firm won’t be able to satisfy its lawful obligations to repay personal debt, shareholders could wander away with nothing at all. Though that is not far too common, we frequently do see indebted firms permanently diluting shareholders due to the fact loan providers drive them to elevate money at a distressed price. Of study course, a good deal of companies use credit card debt to fund advancement, devoid of any negative effects. The to start with factor to do when contemplating how a lot financial debt a business utilizes is to glimpse at its income and debt collectively.

Test out our most current assessment for Ground & Decor Holdings

What Is Flooring & Decor Holdings’s Net Financial debt?

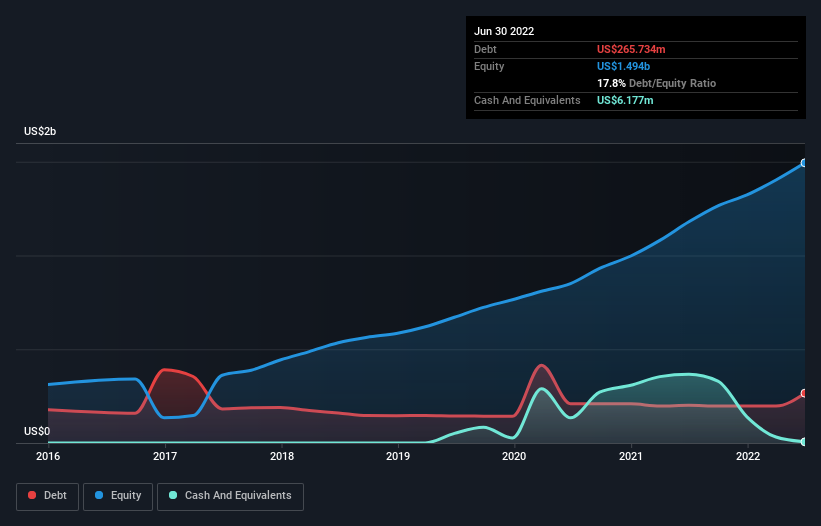

You can simply click the graphic underneath for the historic quantities, but it demonstrates that as of June 2022 Flooring & Decor Holdings experienced US$265.7m of personal debt, an raise on US$200.9m, more than a single year. On the flip side, it has US$6.18m in dollars primary to net debt of about US$259.6m.

A Appear At Ground & Decor Holdings’ Liabilities

We can see from the most latest equilibrium sheet that Flooring & Decor Holdings experienced liabilities of US$1.20b falling because of in just a 12 months, and liabilities of US$1.51b because of beyond that. Offsetting this, it experienced US$6.18m in dollars and US$111.7m in receivables that were owing inside of 12 months. So its liabilities outweigh the sum of its hard cash and (near-term) receivables by US$2.59b.

When this may possibly appear to be like a great deal, it is not so undesirable since Ground & Decor Holdings has a market capitalization of US$7.80b, and so it could likely strengthen its balance sheet by raising funds if it wanted to. Even so, it is nevertheless worthwhile taking a close glimpse at its capacity to spend off personal debt.

We evaluate a firm’s personal debt load relative to its earnings electric power by wanting at its web credit card debt divided by its earnings before desire, tax, depreciation, and amortization (EBITDA) and by calculating how simply its earnings in advance of curiosity and tax (EBIT) go over its interest price (fascination address). As a result we look at debt relative to earnings the two with and with out depreciation and amortization expenses.

Flooring & Decor Holdings’s web personal debt is only .54 instances its EBITDA. And its EBIT addresses its fascination cost a whopping 68. times about. So you could argue it is no a lot more threatened by its credit card debt than an elephant is by a mouse. Flooring & Decor Holdings’s EBIT was fairly flat above the final calendar year, but that shouldn’t be an challenge given the it doesn’t have a large amount of debt. When analysing financial debt degrees, the harmony sheet is the clear put to get started. But in the end the upcoming profitability of the business enterprise will decide if Floor & Decor Holdings can reinforce its balance sheet around time. So if you want to see what the professionals consider, you could uncover this free report on analyst gain forecasts to be fascinating.

Ultimately, a company requirements free dollars movement to pay out off credit card debt accounting earnings just really don’t lower it. So we often test how significantly of that EBIT is translated into cost-free money circulation. Above the very last 3 several years, Flooring & Decor Holdings recorded unfavorable totally free hard cash circulation, in overall. Financial debt is typically more high-priced, and virtually generally extra risky in the hands of a business with destructive free funds movement. Shareholders ought to hope for an advancement.

Our Check out

Flooring & Decor Holdings’s conversion of EBIT to free dollars move and stage of overall liabilities absolutely weigh on it, in our esteem. But the good information is it looks to be capable to address its desire cost with its EBIT with relieve. We think that Flooring & Decor Holdings’s personal debt does make it a bit dangerous, following looking at the aforementioned data points collectively. That’s not always a terrible issue, since leverage can enhance returns on fairness, but it is one thing to be conscious of. When analysing personal debt ranges, the stability sheet is the clear put to begin. But ultimately, just about every firm can consist of hazards that exist outside the house of the harmony sheet. To that conclude, you really should master about the 2 warning signs we’ve spotted with Ground & Decor Holdings (such as 1 which is a bit about) .

At the close of the working day, it is generally improved to aim on corporations that are free of charge from web personal debt. You can obtain our exclusive checklist of this sort of corporations (all with a monitor history of earnings development). It really is no cost.

Have feed-back on this short article? Involved about the information? Get in contact with us instantly. Alternatively, e-mail editorial-group (at) simplywallst.com.

This report by Basically Wall St is common in character. We provide commentary based mostly on historic knowledge and analyst forecasts only working with an impartial methodology and our content are not supposed to be fiscal advice. It does not constitute a suggestion to invest in or market any inventory, and does not choose account of your aims, or your financial condition. We purpose to bring you prolonged-phrase centered examination pushed by essential data. Note that our analysis may not component in the most recent price tag-sensitive firm bulletins or qualitative substance. Basically Wall St has no placement in any shares mentioned.

Valuation is elaborate, but we are encouraging make it straightforward.

Come across out whether Flooring & Decor Holdings is potentially over or undervalued by checking out our extensive evaluation, which contains reasonable benefit estimates, challenges and warnings, dividends, insider transactions and economical health and fitness.

Watch the Absolutely free Investigation