Floor & Decor Holdings’ (NYSE:FND) earnings growth rate lags the 16{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} CAGR delivered to shareholders

When you invest in a stock there is generally a likelihood that it could drop 100{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}. But on a lighter be aware, a fantastic company can see its share rate increase properly more than 100{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}. Very long term Flooring & Decor Holdings, Inc. (NYSE:FND) shareholders would be effectively conscious of this, considering that the inventory is up 108{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in 5 decades. Regretably, even though, the inventory has dropped 8.5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} more than a week. Nevertheless, this could be associated to the in general sector drop of 5.8{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in a week.

Whilst the stock has fallen 8.5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} this week, it’s really worth concentrating on the for a longer period expression and looking at if the shares historic returns have been driven by the underlying fundamentals.

Examine out our latest investigation for Floor & Decor Holdings

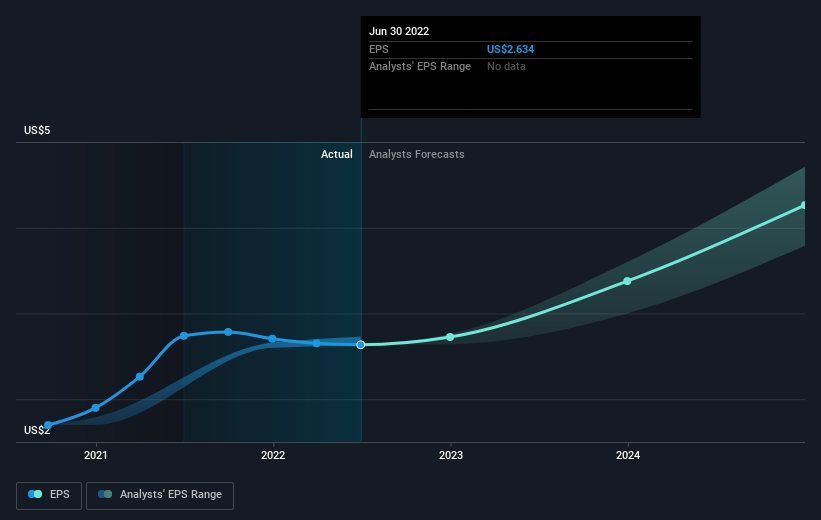

Though markets are a strong pricing system, share charges reflect investor sentiment, not just underlying enterprise efficiency. 1 way to examine how sector sentiment has adjusted around time is to look at the conversation involving a firm’s share price and its earnings for each share (EPS).

In excess of 50 percent a decade, Floor & Decor Holdings managed to develop its earnings per share at 29{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} a yr. The EPS progress is more amazing than the yearly share cost attain of 16{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} over the exact interval. So it appears to be the current market is not so enthusiastic about the inventory these times.

The firm’s earnings for every share (about time) is depicted in the picture underneath (simply click to see the correct numbers).

We take into account it beneficial that insiders have designed substantial purchases in the final year. Even so, foreseeable future earnings will be far additional significant to regardless of whether existing shareholders make funds. Right before shopping for or providing a inventory, we constantly advise a near evaluation of historic expansion traits, offered in this article..

A Distinctive Viewpoint

We regret to report that Ground & Decor Holdings shareholders are down 35{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} for the year. Unfortunately, that’s even worse than the broader current market drop of 18{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}. On the other hand, it could just be that the share rate has been impacted by broader market jitters. It may possibly be worthy of maintaining an eye on the fundamentals, in circumstance there is certainly a good chance. On the vivid side, extended term shareholders have designed funds, with a acquire of 16{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} for each 12 months around fifty percent a ten years. If the fundamental info proceeds to point out long expression sustainable expansion, the present-day market-off could be an prospect worthy of thinking about. It can be normally intriguing to monitor share price performance more than the longer expression. But to understand Floor & Decor Holdings much better, we need to take into account numerous other factors. Choose hazards, for example – Flooring & Decor Holdings has 2 warning symptoms (and 1 which is likely serious) we imagine you need to know about.

If you like to acquire stocks along with management, then you may well just really like this totally free checklist of businesses. (Trace: insiders have been obtaining them).

Be sure to take note, the market place returns quoted in this post reflect the current market weighted regular returns of stocks that presently trade on US exchanges.

Have responses on this report? Involved about the content? Get in touch with us right. Alternatively, electronic mail editorial-crew (at) simplywallst.com.

This short article by Simply just Wall St is normal in character. We present commentary based on historical information and analyst forecasts only utilizing an impartial methodology and our article content are not supposed to be money information. It does not represent a advice to obtain or offer any inventory, and does not just take account of your goals, or your fiscal situation. We purpose to bring you very long-expression centered evaluation pushed by fundamental knowledge. Note that our examination may possibly not issue in the newest cost-sensitive company bulletins or qualitative substance. Merely Wall St has no placement in any stocks outlined.

Be a part of A Paid out User Investigation Session

You are going to get a US$30 Amazon Gift card for 1 hour of your time although aiding us make much better investing tools for the specific traders like your self. Indicator up listed here