Floor & Decor: FY2022 Results Review, Valuation Update (NYSE:FND)

Hard surface flooring shopping – DTF’s Sleep Well Investments

mladenbalinovac/E+ via Getty Images

Introduction

Floor & Decor (NYSE:FND) reported solid FY2022 results. Investors with shorter holding horizons might be disappointed with the store counts guided down. However, I am satisfied and see no change in the long-term thesis.

I am most impressed that Floor & Decor continued to take market share from the big boys, Home Depot (HD) and Lowe’s (LOW), not to mention the independent mom-and-pop shops.

I am sharing my updated valuation with the new numbers and management guidance.

Additionally, I stress-tested the business under my Sleep-well Investment’s stringent checklist and found that FND is investable at the current price.

Before reviewing the earnings report, let’s have a quick recap.

Floor & Decor’s primer

Floor & Decor is a hard-flooring warehouse retailer with a 9{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} market share operating 191 stores across the US. It has a compelling expansion plan that destines to win more market share. At maturity (450 stores in 10 years), I estimate that FND could command 25-30{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of the market at the expense of the industry leaders, Home Depot, Lowe’s, and even more so, the independent and ‘mom-and-pop’ shops.

Solid FY2022 results

Revenue came in at $4.2B, up 24{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} YoY, and operating income was nearly $400M, up 17{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} YoY. Growth was driven by both solid store expansion and growing comparable sales.

It expanded store count rapidly to 191 total, up 32 units YoY, 1 unit less than targeted.

More importantly, organically, full-year comparable sales increased 9.2{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} YoY, and Q4’s comparable sales increased 2.5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} YoY. It shows that in FY2022, FND continued to take share from Home Depot and Lowe’s rapidly, despite being smaller and selling only hard flooring merchandise.

Notably, Home Depot’s comparable sales for flooring materials have been terrible since Q2’22. In Q4’22, it was ‘soft,’ despite HD’s other big-ticket items performing well.

While we saw big-ticket strength across Pro-heavy categories like portable power, hype and fitting, and gypsum, we did experience softness in other categories like laundry, soft flooring, and roofing.

Home Depot Q4’22 earnings call

What I like even more is the comparable sales within the Pros. They are the industry’s most knowledgeable, frequent, and high-ticket buyers segment. Thus, their affinity for FND’s products speaks volumes.

Q4’22 pro comparable store sales increased by 18.8{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} and transactions by 3.9{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} from the fourth quarter of 2021. Their gross spending accounted for 42.2{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of the Q4’22 sales and 40.6{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of FY22 sales. By comparison, Pros accounted for 35{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of FY21 sales. Pro’s membership also grew to 30K in Q4’22, from 29K in Q3’22, and increased by 24{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} YoY from 23K members.

Next, FND’s bottom line remains strong, despite the rapid expansion. Full-year 2022 adjusted diluted earnings per share increased by 13.1{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} to $2.76 from $2.44 in 2021. This is slightly above the low end of the management guidance range of $2.75 to $3 per share they provided at the beginning of fiscal 2022, which did not account for the unknowable economic and geopolitical headwinds that happened during the year.

Expansion plans are slower than expected

Management expects a tougher environment. Thus, they plan to open new stores in the range of 32 to 35 in fiscal 2023 and to be primarily in existing markets and weighted towards the year’s second half.

Investors with shorter investing horizons might be disappointed here. Considering the deteriorating economy and tighter credit market, I see pragmatic and agile management.

Valuation

With more information on the FY2023 stores number, same-store sales, and better-than-expected sales performance, I revise my valuation and see FND as just as attractive as before.

CEO Thomas Taylor’s ten-year target is to build 500 stores. As a reminder, he revised the target two times in the past, from 400 store target at IPO and 315 back in 2012.

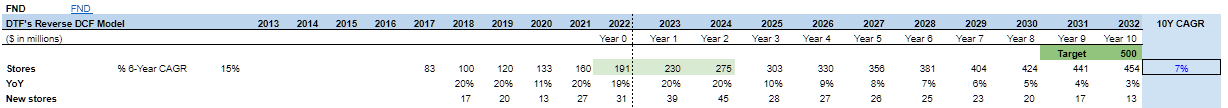

So my original valuation (below) was that FND would build new stores aggressively at a 20{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} CAGR for the next two years (39 stores in FY2023 and 45 stores in FY2024) and then slow down to a 7{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} CAGR until FY2032 to reach 450 stores (base case). Considering the worst-case scenario, I also projected a significant sales decline of 20{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} and 5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in FY2023-2024.

DTF’s Sleep Well Investments

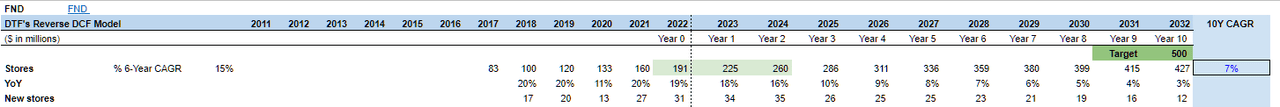

With the new numbers from the FY2022 results report and better FY2023 guidance, below is my revised store expansion plan to 450 stores in 10 years.

DTF’s Sleep Well Investments

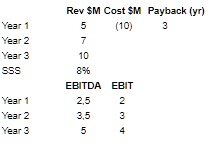

And I am using the new store unit economics per management guidance,

DTF’s Sleep Well Investments

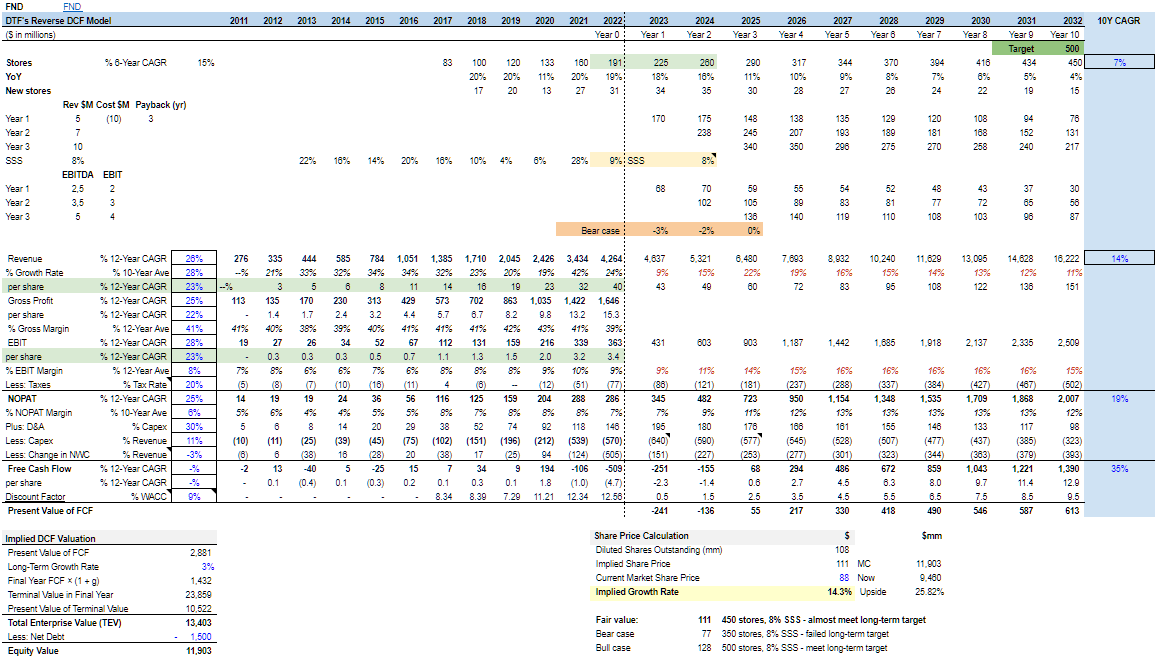

We get to a revenue projection of $16B in year 10, FY2032, assuming an 8{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} SSS and 5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} & 2{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} sales reduction in 2023 and 2024 to consider the impact of the housing market downturn.

With a 9{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} WACC and 3{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} terminal growth, that brings us to $1.4B in FCF by FY2032 and roughly $12B in Market Cap, or $111/share, implying a 26{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} upside from today’s price.

DTF’s Sleep Well Investments – FND’s Valuation (DTF’s Sleep Well Investments)

This is $5/share lower than my original valuation, driven by fewer store openings in the next five years, pushing free cash flow generation further to the later stage. With a high WACC of 9{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}.

Having said that, my DCF valuation still shows an attractive investment today.

In terms of multiples, we can work out the intrinsic value by applying 5x, 10x, and 15x to the terminal FCF, $1.4B, in the base case. You get a ~$7B, ~$15B, and ~$22.5B business in ten years, respectively.

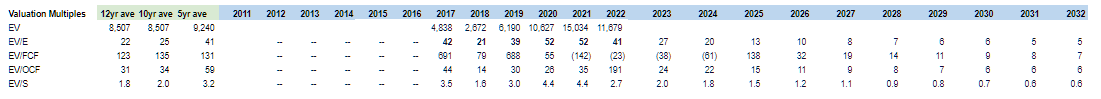

Below are the various multiples from 2017 to 2032 at the base case.

DTF’s Sleep Well Investments Valuation Multiples (DTF’s Sleep Well Investments)

Floor & Decor’s EV/E has ranged from 21x to 52x since IPO. Thus, the stock appears cheap at the FY2023 27x. By 2032, FND could be valued at 5x E and 7x FCF.

Together both valuation methods point to an attractive price. As my base case allows for a 30{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} margin of safety from today’s price, $88/share, I am happy to accumulate my Floor & Decor position to 3{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in size.

Sleep Well Investments Scorecard

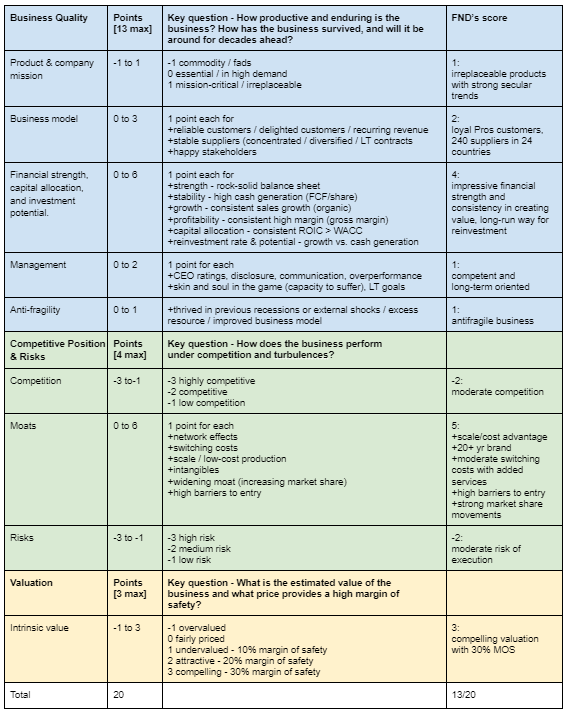

Let’s put Floor & Decor under my Sleep Well Investment stress test.

This final step aims to filter out only businesses that can perform over multiple economic cycles and keep winning market share. Inspired by Nassim Taleb’s anti-fragile concept and studies from various reputable investors, it divides investment criteria into three groups in order of importance:

-

Business quality [13 points]

-

Competitive position and risks [4 points]

-

Valuation [3 points]

Points are deducted for an unconvincing corporate mission, commoditized products, intense competition, and business risks.

The following table shows how I assess these categories and the corresponding Floor & Decor score.

DTF’s Sleep Well Investments checklist (DTF’s Sleep Well Investments)

No business gets full points, but from 13 points, I rate a business as robust and investable. A score above 15 means the business is anti-fragile, thus, time-tested. A score above 16 points means the business is anti-fragile and durable, which likely keeps it winning against competition and future external shocks. Below is how much capital I am comfortable allocating to my portfolio accordingly.

13 = robust business – 1{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}-3{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of the portfolio at cost-basis

15 = antifragile business – 3{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}+

16+ = sleep well business – 5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}+

Additionally, scoring high doesn’t automatically mean an investment. A quality asset that everyone knows about would often mean a high price. Thus, each stock would need to have a price near the bear case scenario and provide a necessary margin of safety (depending on the type of the business and range of outcomes) – to constitute a sleep-well investment. All methods have trade-offs. No investment or checklist is perfect.

Floor & Decor scores 13/20. This is not the highest-quality business in my stock universe, but it has the most apparent and biggest reinvestment potential as a trade-off. It’s also available at an attractive price (currently). There are some uncertainties in the ability to successfully expands to 500 stores, but it is winning market share and has favorable underlying secular trends.

At the current price of ~$88/share, it offers a 30{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} margin of safety, at which point I am happy to accumulate shares to a 3{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} position sizing.