Floor & Decor: Buffett Isn’t The Only Reason I Like It (FND)

RBFried

Investment Thesis

Floor & Decor (NYSE:FND) has received a lot of press over the past couple years after Berkshire Hathaway (BRK.A) (BRK.B) disclosed a stake in the specialty retailer of hard surface flooring and accessories. Personally, I’m of the opinion it wasn’t Warren Buffett himself who initiated the position in Floor & Decor but was most likely one of his portfolio managers. Regardless, the fact Berkshire thought enough of Floor & Decor to add it to the portfolio is definitely a vote of confidence.

There’s a lot to like about Floor & Decor aside from the fact Buffett has a stake. Over the past 10 years, the company has grown revenue at a 28.7{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} CAGR and EPS at a 42.4{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} CAGR. Floor & Decor continues to open additional warehouse stores with a target of 500 total (US) over the next 8-10 years. Currently, Floor & Decor operates 174 warehouse stores which leaves a long runway for growth.

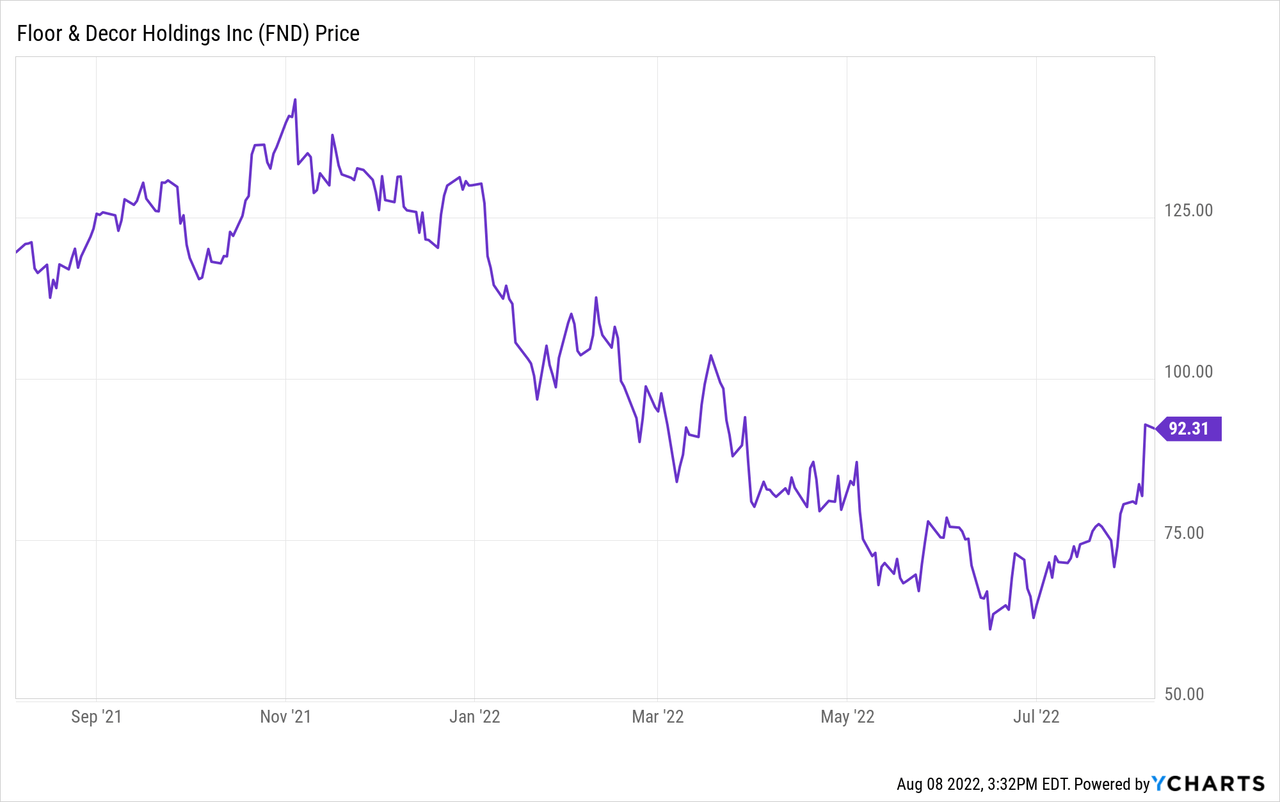

Shares are down 29{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in 2022 compared to the S&P 500’s slide of 13{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}. From a P/E perspective, Floor & Decor hasn’t been this cheap since 2018, aside from the COVID-induced flash crash of 2020. Investors with a multi-year time horizon may consider Floor & Decor’s 2022 slump an opportunity to pick up a profitable growth company at a reasonable price.

The Differentiator

Floor & Decor stands out from the competition by dedicating more floor space to its focused product – hard surface flooring. The company’s warehouse stores average 78,000 square feet and are fully dedicated to tile, wood, laminate, vinyl, and natural stone flooring along with decorative and installation accessories. To put it in perspective, Lowe’s (LOW) stores average around 115,000 square feet. So, imagine filling 70{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of a Lowe’s store with hard surface flooring and you’ll get a good sense of what Floor & Decor looks like.

For those who have shopped at Sam’s Club or Costco (COST), what impact does buying in bulk have on your wallet? It saves you money. Sam’s and Costco are able to offer products cheaper than the competition because 1) they operate a membership model and don’t waste money on expensive advertising, etc… and 2) because they buy in bulk (and offer products in bulk). This is similar to Floor & Decor’s model minus the membership fee.

With each store averaging around 78,000 square feet dedicated to hard surface flooring, Floor & Decor has to order a lot of products. And with a lot of products comes improved pricing per item based on quantity ordered. The result – Floor & Decor is able to offer the widest selection (in stock) of products at competitive, if not cheaper, prices compared its competition.

A Dedicated Focus on Pro Customers

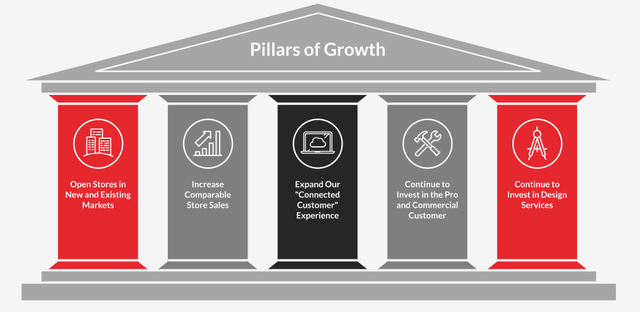

A key differentiator between Home Depot (HD) and Lowe’s is Home Depot has done a better job acquiring the Pro customer. Floor & Decor is following in Home Depot’s footsteps with a dedicated focus on Pros who shop more frequently and spend more per ticket. Indeed, continuing to invest in the Pro and Commercial customer is one of Floor & Decor’s five pillars of growth.

FND Pillars of Growth (FND IR Website)

The company speaks in detail on their strategy and focus on acquiring and retaining the Pro customer. Here’s an excerpt from Floor & Decor’s IR website.

We believe our differentiated focus on Pro customers has created a competitive advantage for us and will continue to drive our net sales growth. We will invest in gaining and retaining Pro customers due to their frequent and high-ticket purchases, loyalty, and propensity to refer other potential customers. We have made important investments in the Pro services regional team, including the additional Regional Pro Directors, to better recruit and train the Pro services team in each store. We have also invested in technology, such as an integrated CRM, to help us further penetrate and grow our Pro business, dedicated phone lines for our Pro customers to call and text, commercial credit and open account terms, jobsite delivery, a dedicated website for Pro customers, a growing and successful Pro loyalty program, training on technical flooring installation solutions, and tools to facilitate large commercial jobs sourced throughout the store.

A Roadmap For Growth

I appreciate a company that establishes long-term goals for itself and communicates those goals to shareholders. Floor & Decor has communicated the following long-term goals to shareholders:

- $17 billion in revenue and 500 warehouse stores in the US (174 stores currently) within 8-10 years

- 20{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} growth in store count annually

- At least 20{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} revenue CAGR 2022-2024

- Doubling adjusted operating income between 2021 and 2024 (~25{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} CAGR)

- Adjusted EBITDA margin in the mid-teens

CEO Tom Taylor made the following remark during the Q2 2022 earnings call.

We are enthusiastic about continuing to partner with Trevor as we execute our long-term plan towards $17 billion in sales and 500 stores.

Forecasting Revenue Growth

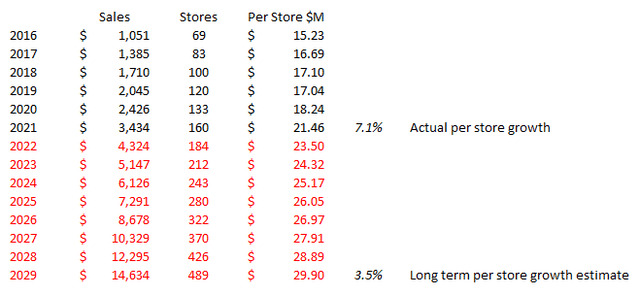

Based on history and using a conservative estimate, I believe Floor & Decor has a good chance of hitting $15 billion in revenue by 2030 assuming they continue adding 15{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} to their total store count each year. Reminder, their goal is to add 20{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} to total store count annually.

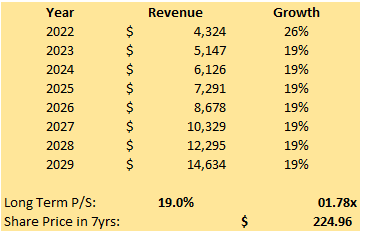

FND Forecasted Revenue Growth (Author’s personal data)

In the above, I divided total revenue by number of stores open at year’s end to calculate revenue per store. From 2016 to 2021, per store revenue growth increased 7.1{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} annually. For 2022 and beyond, I assumed total store growth of 15{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} annually and a 3.5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} per store sales growth, which is conservative compared to the previous years’ actuals of 7.1{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}. I then multiplied the number of stores by the per store sales to calculate total revenue. This resulted in a 2029 revenue estimate just shy of $15 billion which equates to a 19{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} CAGR from 2022 to 2029.

Valuation

Floor & Decor is investing heavily into capex to support store expansion and technology advancements. As a result, I’ll use the market multiple approach to value shares as well as a historical P/S.

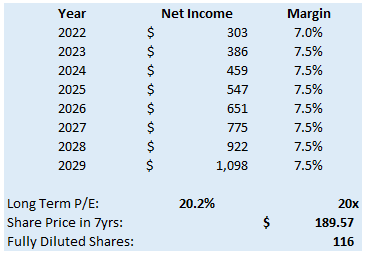

Market multiple approach (P/E)

Using the market multiple approach, I arrive at a 2029 target price of $190 for Floor & Decor. I assumed 19.0{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} revenue growth (as outlined above), a 7.5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} net margin (slightly below the 5-YR average of 7.6{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}), 1{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} annual share dilution, and a long-term P/E of 20.

FND Net Income Forecast (Author’s personal data)

Price to sales approach

I typically don’t like using P/S for valuation, but in this case, Home Depot and Lowe’s give us a decent guidepost on expectations for Floor & Decor. According to Seeking Alpha, Home Depot’s 5-YR average P/S is 2.25 compared to Lowe’s 1.32 for an average of 1.78. I used a long-term P/S of 1.78 for this valuation.

Using P/S, I arrive at a 2029 target price of $225 for Floor & Decor.

FND P/S Valuation (Author’s personal data)

Average of both methods

With a $190 valuation using P/E and $225 using P/S we arrive at an average valuation of $208 by 2029. From today’s price of $92.25, this equates to a 12.4{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} CAGR which, when compared to the S&P 500’s average of 7 to 10{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} annually, represents a market-beating return for Floor & Decor.

Bear Case

No investment is without its risks. Here’s my bear case for Floor & Decor.

My bear case is tied to rising mortgage rates, a slowdown in new housing construction, and a prolonged recession resulting in a shift in consumer spending. Two out of three of these concerns have already come to fruition. The only one we’re unsure of at this time is if the current recession will be short or long-lived. In hard economic times, consumers will conserve money and be less likely to opt for a new house, remodel, or renovation. Floor & Decor’s revenue and earnings are sure to take a hit as a result. I don’t believe this negates the thesis, but it most assuredly would extend the time needed for it to play out.

Conclusion

Floor & Decor is a profitable growth company offering a differentiated business model compared to some of its publicly traded peers. The company has an impressive track record of revenue and earnings growth and has set its sights on $17 billion in revenue and 500 stores within the next 8 to 10 years. Management has shown their ability to execute in the past, and I see a reasonable path to $15 billion in revenue by 2030. With an estimated 7-YR share CAGR of 12.4{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}, I believe Floor & Decor has a good chance of providing market-beating returns to investors over the next several years.