Do Floor & Decor Holdings’ (NYSE:FND) Earnings Warrant Your Attention?

For novices, it can feel like a superior concept (and an fascinating prospect) to purchase a organization that tells a superior tale to investors, even if it at the moment lacks a monitor history of income and revenue. Often these stories can cloud the minds of investors, primary them to invest with their thoughts somewhat than on the merit of superior firm fundamentals. While a nicely funded firm could sustain losses for several years, it will want to generate a financial gain eventually, or else buyers will move on and the company will wither away.

If this form of company isn’t really your type, you like firms that make earnings, and even make revenue, then you could nicely be intrigued in Floor & Decor Holdings (NYSE:FND). Even if this corporation is pretty valued by the market, investors would concur that building dependable income will proceed to deliver Ground & Decor Holdings with the means to incorporate prolonged-term value to shareholders.

Verify out our most current evaluation for Ground & Decor Holdings

How Speedily Is Flooring & Decor Holdings Expanding Earnings Per Share?

If you consider that markets are even vaguely economical, then around the very long time period you would anticipate a company’s share price tag to abide by its earnings per share (EPS) outcomes. That suggests EPS advancement is thought of a genuine constructive by most successful prolonged-term buyers. Shareholders will be pleased to know that Flooring & Decor Holdings’ EPS has developed 30{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} every single yr, compound, more than a few a long time. If the company can maintain that sort of expansion, we might hope shareholders to occur absent pleased.

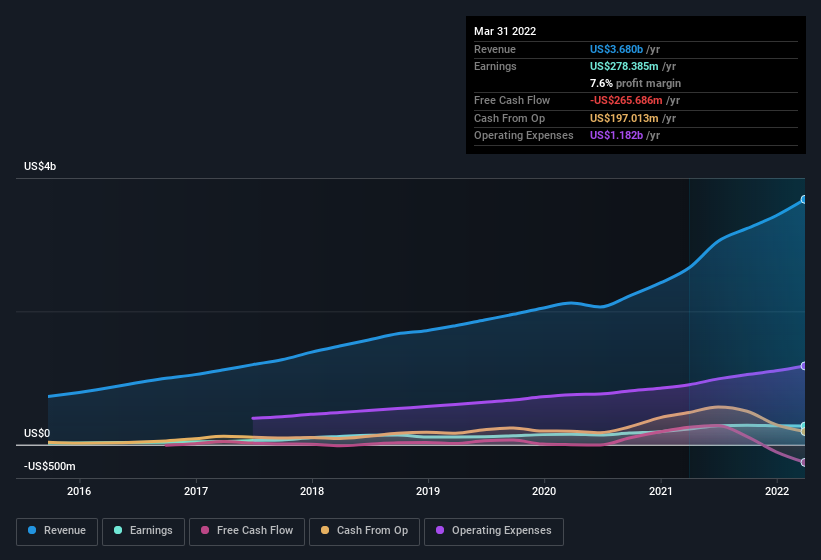

One particular way to double-check a company’s advancement is to glimpse at how its revenue, and earnings in advance of interest and tax (EBIT) margins are altering. Even though we take note Floor & Decor Holdings achieved identical EBIT margins to final year, income grew by a solid 39{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} to US$3.7b. Which is encouraging information for the organization!

In the chart beneath, you can see how the company has developed earnings and profits, in excess of time. To see the precise figures, click on on the chart.

The trick, as an investor, is to uncover companies that are heading to accomplish very well in the future, not just in the past. While crystal balls will not exist, you can examine our visualization of consensus analyst forecasts for Floor & Decor Holdings’ upcoming EPS 100{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} cost-free.

Are Ground & Decor Holdings Insiders Aligned With All Shareholders?

Since Ground & Decor Holdings has a current market capitalisation of US$8.4b, we would not hope insiders to keep a large percentage of shares. But we do just take comfort and ease from the truth that they are investors in the corporation. We take note that their impressive stake in the organization is well worth US$156m. Investors will appreciate administration having this volume of skin in the recreation as it exhibits their commitment to the company’s upcoming.

It can be good to see that insiders are invested in the organization, but are remuneration degrees realistic? A short evaluation of the CEO payment implies they are. Our analysis has found out that the median full compensation for the CEOs of firms like Flooring & Decor Holdings with sector caps involving US$4.0b and US$12b is about US$8.4m.

Flooring & Decor Holdings’ CEO took house a full compensation offer worth US$5.1m in the year primary up to December 2021. That looks fairly fair, in particular supplied it truly is below the median for very similar sized providers. Even though the amount of CEO payment shouldn’t be the biggest issue in how the company is viewed, modest remuneration is a beneficial, because it implies that the board retains shareholder pursuits in mind. It can also be a indication of a culture of integrity, in a broader sense.

Does Ground & Decor Holdings Have earned A Spot On Your Watchlist?

You won’t be able to deny that Flooring & Decor Holdings has developed its earnings for every share at a really extraordinary fee. That is attractive. If you will need additional convincing outside of that EPS advancement level, never neglect about the acceptable remuneration and the large insider ownership. Anyone has their very own preferences when it arrives to investing but it undoubtedly helps make Floor & Decor Holdings seem fairly intriguing indeed. However, you ought to discover about the 1 warning sign we have noticed with Ground & Decor Holdings.

There is constantly the risk of accomplishing properly obtaining stocks that are not rising earnings and do not have insiders acquiring shares. But for all those who consider these critical metrics, we encourage you to test out providers that do have individuals attributes. You can obtain a totally free list of them in this article.

Remember to be aware the insider transactions reviewed in this short article refer to reportable transactions in the applicable jurisdiction.

Have feedback on this article? Concerned about the information? Get in contact with us immediately. Alternatively, e mail editorial-crew (at) simplywallst.com.

This article by Only Wall St is common in mother nature. We supply commentary centered on historic facts and analyst forecasts only utilizing an unbiased methodology and our content articles are not supposed to be monetary information. It does not constitute a advice to get or provide any inventory, and does not take account of your aims, or your financial circumstance. We aim to convey you long-time period targeted assessment driven by fundamental info. Notice that our analysis may well not component in the newest selling price-delicate enterprise bulletins or qualitative product. Merely Wall St has no placement in any stocks mentioned.