At US$80.03, Is It Time To Put Floor & Decor Holdings, Inc. (NYSE:FND) On Your Watch List?

Even though Floor & Decor Holdings, Inc. (NYSE:FND) may possibly not be the most greatly identified stock at the moment, it observed a substantial share cost increase of over 20{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in the previous few of months on the NYSE. With lots of analysts masking the mid-cap inventory, we could hope any price tag-delicate bulletins have already been factored into the stock’s share selling price. But what if there is nonetheless an prospect to get? Let’s analyze Floor & Decor Holdings’s valuation and outlook in more depth to ascertain if there’s still a deal prospect.

What Is Flooring & Decor Holdings Well worth?

According to my cost numerous design, the place I look at the firm’s rate-to-earnings ratio to the market typical, the stock presently seems highly-priced. In this occasion, I have employed the price tag-to-earnings (PE) ratio provided that there is not enough details to reliably forecast the stock’s income flows. I locate that Ground & Decor Holdings’s ratio of 30.6x is over its peer common of 6.71x, which implies the inventory is trading at a larger value as opposed to the Specialty Retail field. But, is there a different chance to invest in minimal in the long run? Given that Flooring & Decor Holdings’s share is reasonably unstable (i.e. its cost movements are magnified relative to the relaxation of the industry) this could mean the selling price can sink reduce, providing us one more possibility to acquire in the foreseeable future. This is based mostly on its high beta, which is a good indicator for share cost volatility.

What does the long run of Ground & Decor Holdings appear like?

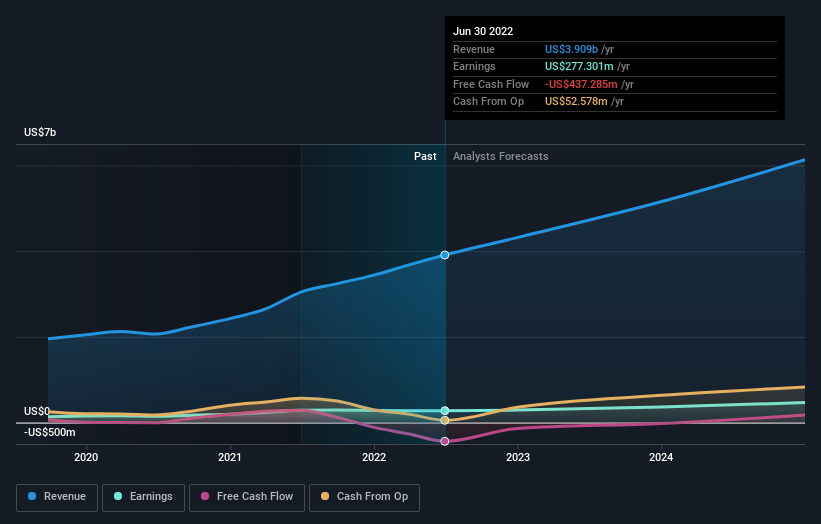

Investors on the lookout for advancement in their portfolio may well want to look at the prospective buyers of a company ahead of obtaining its shares. Acquiring a excellent firm with a robust outlook at a affordable cost is usually a fantastic financial investment, so let us also consider a look at the company’s long run anticipations. Floor & Decor Holdings’ earnings above the following number of many years are predicted to increase by 76{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}, indicating a extremely optimistic future forward. This really should lead to more strong money flows, feeding into a better share value.

What This Suggests For You

Are you a shareholder? FND’s optimistic upcoming advancement appears to have been factored into the present share rate, with shares buying and selling previously mentioned market selling price multiples. At this present cost, shareholders may well be asking a unique dilemma – ought to I provide? If you consider FND should really trade under its present value, selling substantial and buying it back again up yet again when its rate falls in the direction of the sector PE ratio can be rewarding. But just before you make this decision, just take a glance at no matter if its fundamentals have adjusted.

Are you a probable investor? If you have been keeping an eye on FND for a while, now may perhaps not be the ideal time to enter into the stock. The cost has surpassed its industry friends, which implies it is very likely that there is no more upside from mispricing. Having said that, the positive outlook is encouraging for FND, which implies it is well worth diving deeper into other variables in buy to choose edge of the upcoming price fall.

With this in intellect, we would not consider investing in a stock except we experienced a extensive being familiar with of the pitfalls. Be conscious that Ground & Decor Holdings is exhibiting 2 warning symptoms in our financial commitment assessment and 1 of these should not be disregarded…

If you are no more time intrigued in Flooring & Decor Holdings, you can use our free system to see our listing of about 50 other shares with a high advancement potential.

Have comments on this article? Anxious about the content material? Get in touch with us specifically. Alternatively, e-mail editorial-group (at) simplywallst.com.

This posting by Merely Wall St is typical in mother nature. We deliver commentary primarily based on historic facts and analyst forecasts only utilizing an unbiased methodology and our posts are not supposed to be fiscal suggestions. It does not represent a advice to purchase or provide any stock, and does not just take account of your targets, or your economic problem. We intention to deliver you very long-time period concentrated examination pushed by elementary data. Notice that our assessment may perhaps not component in the latest price tag-delicate firm announcements or qualitative substance. Just Wall St has no place in any shares described.

The sights and opinions expressed herein are the views and views of the writer and do not always mirror these of Nasdaq, Inc.