2 Beaten-Down Stocks Warren Buffett Should Double Down On

Among the the quite a few Warren Buffett prices thrown all-around, none has caught the creativity a lot more than his timeless, “be fearful when other folks are greedy, and greedy when many others are fearful” nugget.

And it seems to be like 2023 will be the perfect option for Buffett to when again display his use of the axiom. At the very least that is the belief of Elon Musk, who not too long ago claimed he “suspects Warren Buffett is heading to be obtaining a great deal of stock upcoming yr.”

Having known as Buffett a “bean counter” in the previous, Musk is not renowned for currently being a admirer of the investing legend, but the Tesla/Twitter/SpaceX CEO can evidently see the merit in Buffett’s value-pushed strategy.

“If a enterprise has pretty potent fundamentals, but then the marketplace is undertaking some brief-phrase panic condition, naturally which is the appropriate time to invest in inventory.” Musk opined.

We know that that is just what Buffett likes and with the industry acquiring absent into meltdown mode in excess of the training course of the past 12 months, Buffett may be getting prepared to pounce.

So, let’s consider a look at a couple of stocks by now getting up area in the The Oracle of Omaha’s portfolio but which have observed significant losses above the past yr, making these overwhelmed-down names probable candidates for some Buffett obtaining motion.

With aid from the TipRanks databases, we can uncover out whether the Street’s analysts also believe these names give chances at present levels. Let us acquire a closer appear.

Snowflake Inc. (SNOW)

Let us start out with Snowflake, a organization that could the moment be described as the poster boy for richly valued tech shares. The details warehousing professional manufactured a significant entrance into the public markets in September 2020, in what was the largest-at any time software program IPO, with the corporation getting the major to double its current market cap on the to start with day of investing.

Making use of cloud-based mostly hardware and software, the firm allows its buyers to keep and analyze data, and irrespective of its prosperous valuation periodically getting known as into dilemma, Snowflake has continued to develop at an amazing rate.

This was also the situation in the most a short while ago described quarter – for the third quarter of fiscal 2023. Income rose by 67{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} calendar year-around-yr to $557.03 million, beating the Street’s forecast by $18.12 million. Amounting to 66{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} 12 months-more than-12 months expansion, remaining performance obligations (RPO) – the metric signifies promotions that will crank out revenues in the potential – hit $3 billion, though the business posted an impressive internet profits retention price of 165{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}. Snowflake defeat expectations on the bottom-line way too, as adj. EPS of $.11 trumped the $.05 consensus estimate.

The shares, however, have encountered a comparable fate to other tech names. Worries about inflation and progress in the facial area of global economic unrest have triggered tech shares to reduce acceptance, and as a consequence, Snowflake shares shed 58{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} of their worth final 12 months.

Buffett now owns 6,125,376 SNOW shares – currently value just below $830 million – and staying Buffett, the fall could entice the investing legend to load up.

JMP analyst Patrick Walravens absolutely thinks which is what traders must do. The analyst lists several reasons for using a bullish SNOW see. These consist of: “1) the enterprise is disrupting the knowledge administration business with its details cloud and cloud-indigenous architecture and with its philosophy of “enabling the do the job to come to the data” 2) the firm has 287 consumers with more than $1M in item revenue (up 94{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} y/y), and 6 of Snowflake’s top rated 10 shoppers grew quicker than the corporation all round quarter-about-quarter in F3Q, 3) the cloud info system addresses a massive ~$248B TAM 4) Snowflake is led by a premier administration workforce, which include CEO Frank Slootman and CFO Mike Scarpelli and 5) the organization continues to increase quickly at scale, whilst delivering impressive operating leverage, with a non-GAAP working margin of 7.8{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} in F3Q, up from 3.5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} last quarter.”

Quantifying his reviews, Walravens prices SNOW shares an Outperform (i.e., Obtain) together with a $215 value target. Traders are seeking at 12-thirty day period returns of ~46{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}, should the forecast work out as planned. (To enjoy Walravens’ monitor file, click in this article)

Most on the Avenue agree based on 17 Buys vs. 7 Retains, SNOW inventory claims a Reasonable Buy consensus ranking. At $187, the typical concentrate on implies 1-year share appreciation of 26{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}. (See Snowflake stock forecast on TipRanks)

Floor & Decor Holdings (FND)

The second crushed-down we’ll seem at is Floor & Decor, a specialty retailer concentrated specializing in hard floor flooring – tile, stone, wooden, laminate, vinyl – and linked components, with its purchaser base ranging from the Do-it-yourself group to professional installers and professional entities. Considering that forming in 2000, the organization has observed some significant development and now offers 178 warehouse-structure shops and 5 style and design studios spread out across 35 states.

The expansion – albeit slower – was on faucet once again when the corporation claimed FQ3 financials in early November. Earnings hit $1.1 billion, amounting to a 25.5{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} 12 months-over-12 months uptick whilst comp shop income rose by 11.6{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} from the very same period of time a calendar year back. Adjusted diluted EPS climbed by 16.7{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} to $.70. Both the top-and base-line figures beat anticipations.

That explained, the deteriorating macro disorders saw the firm supply a disappointing FY outlook, with internet income expected in the selection amongst $4.25 billion to $4.285 billion, beneath consensus at $4.32 billion.

The story all-around FND’s crushed-down share price – the stock get rid of 46{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} through 2022 – is one particular of worry all-around the slowing housing industry from a backdrop of soaring inflation and climbing fascination prices.

But that share rate drop may well entice Buffett to insert to his posture. He at the moment owns 4,780,000 shares, worth pretty much $333 million.

Turning to the analyst local community, Evercore’s Greg Melich thinks that at current ranges, the “risk/reward on FND is favorable into 2023.”

“The essential story of 15-20{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} sq footage progress, expansion of pro, digital, and solutions to generate share and gain gain stays intact – even in a softening economic system,” the analyst explained. “Given that FND’s prolonged-expression advancement narrative (both organically and by means of store growth) remains in-location and gain margins remain structurally elevated, possibility stays.”

Accordingly, Melich charges FND shares an Outperform (i.e. Get) while his $90 cost focus on indicates the inventory will be changing palms for a 36{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d} top quality a yr from now. (To enjoy Melich’s track document, simply click in this article)

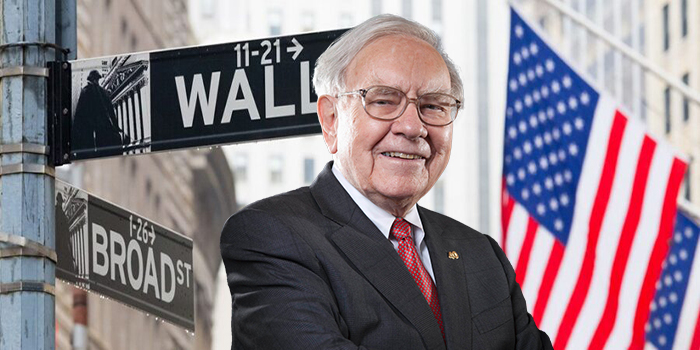

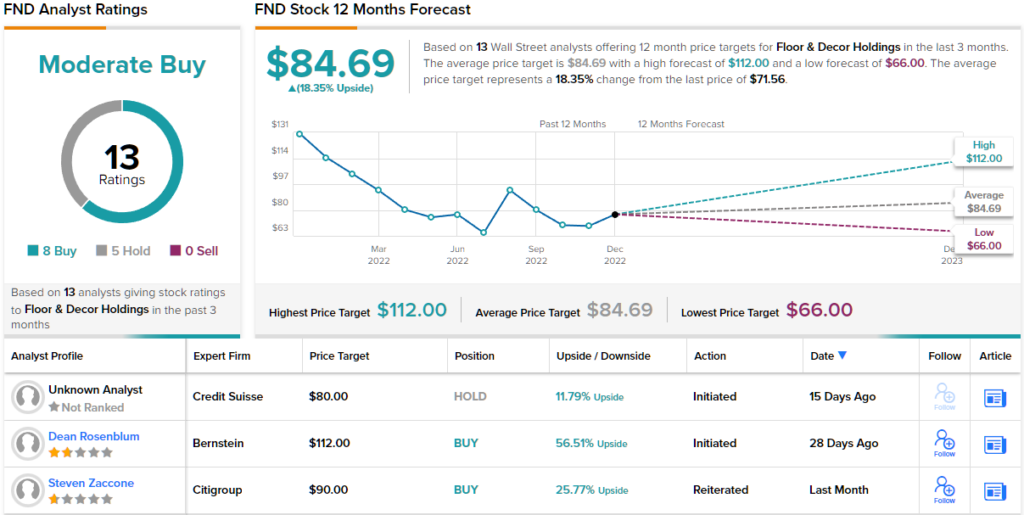

Total, 13 analysts have thrown the hat in with FND reviews, and these crack down 8 to 5 in favor of Purchases about Retains. The average focus on stands at $84.69, implying possible just one-calendar year upside of ~18{a57a8b399caa4911091be19c47013a92763fdea5dcb0fe03ef6810df8f2f239d}. (See FND inventory forecast on TipRanks)

To locate good strategies for stocks investing at attractive valuations, visit TipRanks’ Best Stocks to Get, a recently introduced instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed in this posting are solely those of the featured analyst. The information is supposed to be employed for informational uses only. It is extremely essential to do your own investigation right before building any financial commitment.